Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Budget impact on UK firms tops £1 billion as hiring slows

UK firms from the retail, leisure, hospitality, manufacturing, logistics and housebuilding sectors have said they will incur additional costs due to the increases in the national living wage and employers’ national insurance contributions announced in the Budget on 30 October. According to Reuters the total declared impact is now £1.1 billion.

Some of the sectors most affected include retail (the largest employer in the private sector with 4.9 million employees as of 2023), leisure and hospitality because of the volume of staff they employ operating on relatively low wages.

The changes could put additional pressure on already strained businesses and raise the stakes as the crucial festive trading period gets into full swing.

Popular pizza chain Domino’s Pizza (DOM) said on 9 December it will take a £3 million ongoing annual hit from the changes.

Supermarket group Sainsbury’s (SBRY), which employs around 150,000 people, said it was possibly facing ‘headwinds’ of £140 million.

Pub group JD Wetherspoon (JDW), which employs more than 40,000 people, said its annual costs would increase by an estimated £60 million in 2025.

Another pub group, Marston’s (MARS), which operates 1,339 pubs in the UK with about 11,000 employees, said it expects a £4 million impact due to wage inflation and another £4.6 million from additional employment costs in fiscal 2025.

Also heavily impacted is Royal Mail owner International Distribution Services (IDS) which employs nearly 130,000 people in the UK. The firm said national insurance changes will cost them around £120 million a year.

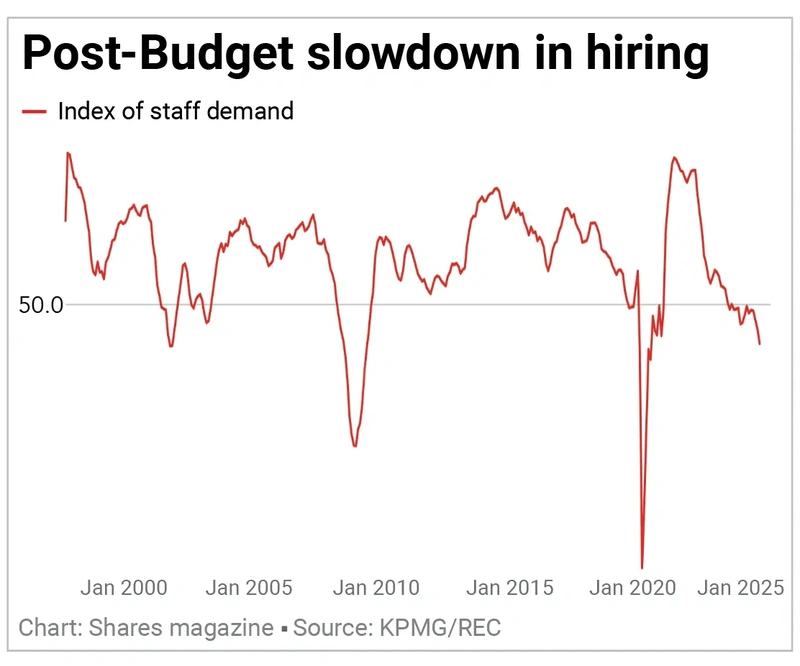

The latest figures on recruitment suggest the Budget is having a knock-on effect on hiring decisions.

Data produced by S&P Global on behalf of KPMG and the REC (Recruitment & Employment Confederation) shows employers are becoming increasingly reluctant to hire full-time staff.

During November demand for staff hit the lowest level since August 2020 amid moderating growth in permanent salaries.

Jon Holt, group chief executive and UK senior partner KPMG, says: ‘Businesses are having to weigh up the prospect of increasing employee costs following the Budget, which has led to an accelerated slowdown in hiring activity across the board.

‘While the data was already heading in that direction, permanent placements saw their steepest reductions in over a year last month, and temporary roles also saw a fifth consecutive decline.’

Easing wage inflation may be welcomed by the Bank of England as it weighs its latest decision on interest rates next week.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

Money Matters

News

- Can Chemring profit play catch-up after slow start to the year?

- Why Rolex seller Watches of Switzerland has clocked up a 40% gain in six months

- China eases monetary policy ahead of Trump 2.0 and global tariff war

- Budget impact on UK firms tops £1 billion as hiring slows

- Frasers shares down 30% year-to-date as Budget blues bite

magazine

magazine