Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The lack of any great price momentum in Apple’s stock suggests expectations for the iPhone 7 are relatively low compared to previous launches as company CEO Tim Cook prepares to unveil the next-generation product, potentially on Wednesday at the Bill Graham Civic Auditorium in San Francisco.

Russ Mould, investment director at AJ Bell, comments:

“Apple’s share price is up by just 6% over the last six months – this compares to the average 23.6% gain in the six-month periods seen ahead of the previous launches of iPhone 1, 3G, 4, 5 and 6.

“History also suggests that Apple stock has tended to price in much of the good news regarding a new product release ahead of the fact, looking at how the shares on average ran up strongly going into prior key launches and then trod water afterwards (although there is a wide range of performance from cycle to cycle).

|

|

Share price performance |

|

Product |

Launched |

6 months before launch |

6 months after launch |

iPhone 1 |

29-Jun-07 |

43.8% |

63.7% |

iPhone 3G |

11-Jul-08 |

-0.1% |

-47.5% |

iPhone 4 |

24-Jun-10 |

28.7% |

20.3% |

iPhone 5 |

21-Sep-12 |

16.2% |

-35.3% |

iPhone 6 |

19-Sep-14 |

29.1% |

8.1% |

AVERAGE |

|

23.6% |

1.9% |

Source: Thomson Reuters Datastream

“If iPhone 7 shows little more than a series of cosmetic, incremental upgrades that will raise the stakes for iPhone 8, the tenth anniversary product which is due for release in 2017.

“A flat-lining share price this autumn could just push boss Cook further into the spotlight, as he becomes embroiled in a tax row with the EU and tries to revive the company’s flagging momentum.

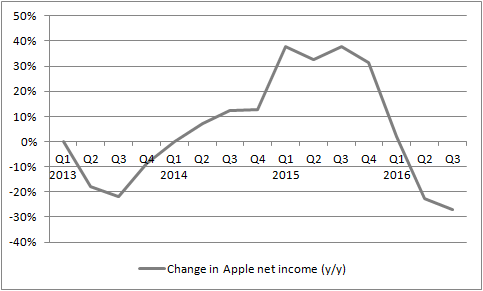

“In the quarter to June, net profit fell 27% year-on-year, the steepest drop for more than a decade, although Apple suffered a similar swoon in 2013 and then bounced back quickly:

Source: Apple accounts, based on company's fiscal year (ends October-September)

“Cook has bought time with increased dividend payments and a stock buy-back programme, but ultimately investors want to buy into Apple for its competitive advantage, leading products and the benefits it reaps from the ecosystem of app developers – and not mere financial engineering.

“Apple Car looks to have stalled, Apple Watch has yet to fire consumers’ or investors’ imaginations and many will have nodded off while waiting for Apple TV to grab their attention, so Cook still faces the unenviable (and some would say impossible) task of proving he can drive forward the company’s product roadmap as effectively as his predecessor, Steve Jobs.”

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17