Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

This could be the latest test of Sir John Templeton’s so-called principle of maximum pessimism. The fund management legend once stated, ‘People are always asking me where the outlook is good, but that is the wrong question. The right question is: where is the outlook most miserable?’

India’s headline Sensex stock market index trades at all-time highs, as do Brazil’s BOVESPA and South Africa’s JSE All-Share benchmark, as if to back up Sir John’s assertion. Brazil’s BOVESPA is down slightly in 2024, but China is the one to really let the side down, as the CSI 300 still trades no higher than it did in 2007, even after its recent rally.

And that rally shows how easy it could be for sentiment to turn.

Fresh measures from Beijing to stimulate its flagging economy have given the headline indices in Shanghai and Hong Kong a huge boost. So downbeat was sentiment, and so lowly were valuations, that it took relatively little to stoke fresh interest.

| Equity index | Country | Capital return in 2024 to date (%) |

|---|---|---|

| S&P 500 | USA | 22.5% |

| NASDAQ Composite | USA | 22.4% |

| Hang Seng | Hong Kong | 21.9% |

| DAX | Germany | 17.1% |

| FTSE All-World | Global | 17.0% |

| S&P/TSX | Canada | 16.9% |

| Nikkei 225 | Japan | 16.3% |

| Dow Jones Industrials | USA | 14.7% |

| FTSE/JSE All-Share | South Africa | 12.6% |

| BSE Sensex | India | 12.1% |

| SSMI | Switzerland | 10.8% |

| CSI 300 | China | 10.4% |

| FTSE 100 | UK | 8.3% |

| CAC 40 | France | 1.0% |

| BOVESPA | Brazil | (2.5%) |

Source: LSEG Refinitiv data. Local currency terms to 17 October.

It remains to be seen whether China’s recovery can be sustained, and some disappointment is already creeping in judging by the cool reception given to the latest announcements from the Ministry for Housing and Urban-Rural Development.

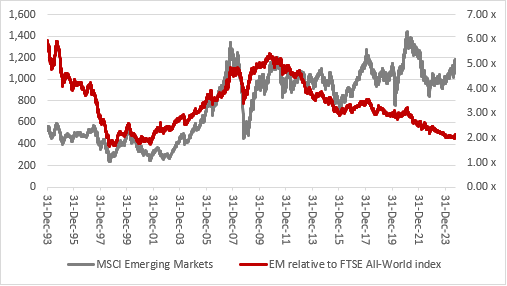

Even so, this is a timely reminder that Emerging Markets overall have underperformed Developed Markets for more than a decade. On a relative basis, Emerging Markets trade no higher now compared to Developed Markets than they did in 2001, after which point the bursting of the tech bubble and return to favour of cyclical, value stocks brought Emerging Markets back into favour.

Source: LSEG Refinitiv data

Contrarian investors could therefore be forgiven for asking themselves whether it is now time for a fresh look at Emerging Markets, given how the world is once more in thrall to tech stocks and US equities in particular.

China and Hong Kong have given one hint of what could be a potential catalyst for stronger performance from Emerging Markets, in relative and absolute terms, namely fiscal and particularly monetary stimulus.

Beijing has cut interest rates, lowered the amount of capital that banks had to hold (so they could lend more) and eased the rules on consumer purchases of property. There is still much more to do, if China is to sustainably boost growth and ensure that consumption becomes its main economic engine instead of construction and exports, and proposals for land reform at July’s Third Plenum offer a hint of what may be to come.

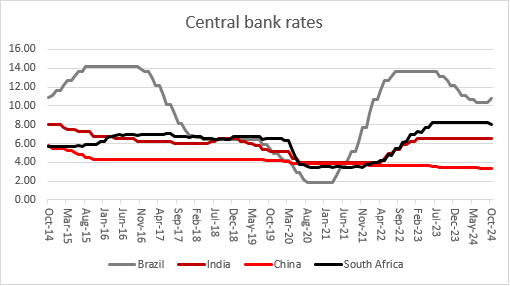

More widely, interest rate cuts could help Emerging Markets, whose central banks were generally quicker to hike headline borrowing costs as inflation broke out in the wake of the pandemic. They now have scope to cut rates, especially as the US Federal Reserve has started to do the same. Emerging Markets have had to wait, because their currencies would have weakened (and given inflation fresh impetus) had they moved before the Fed.

Lower rates could boost local GDP growth and benefit corporate earnings across markets which can be heavily exposed to cyclicals and financials, and other economically sensitive sectors, either domestically or across international markets.

Source: LSEG Refinitiv data

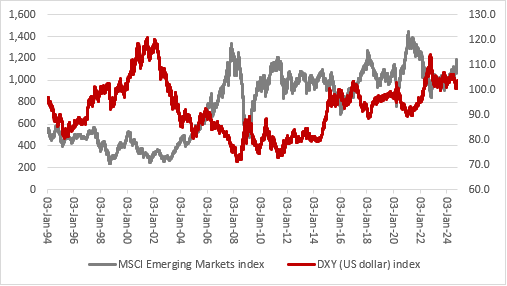

If the Fed really gets going on interest rate cuts, then the dollar could weaken. A drop in the buck, as benchmarked by the trade-weighted DXY (or ‘Dixie’) index, is traditionally seen as helpful for Emerging Markets, especially those with dollar borrowings. Lower rates and a softer dollar lower the cost of servicing those overseas debts and the reduced interest bills leave scope for more proactive government investment elsewhere.

Source: LSEG Refinitiv data

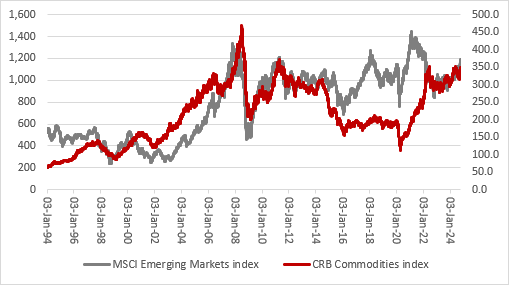

If interest rate cuts and a weaker dollar are two possible catalysts for improved Emerging Market equity market performance, then a third is strength in commodity prices.

This could reflect how some Emerging Markets are key producers and exporters of raw materials, notably Brazil and South Africa. It may also be the result of how Emerging Markets are plugged into global growth more widely through their exports (and if global growth is strong then demand for commodities is likely to be elevated). Commodities can also do well when inflation is running strongly, as investors seek havens and assets that can protect wealth relative to cash and paper assets, and also feel less inclined to pay up for secular growth assets when cyclical growth is more freely (and probably cheaply) available from value plays, such as Emerging Markets.

Source: LSEG Refinitiv data

The dangers to Emerging Markets are therefore that the US cuts rates more slowly than thought, the dollar gains ground, inflation remains subdued and commodity prices soften, to continue the world’s love affair with tech and America – in other words, the trends of the last two decades stay in place to leave Emerging Markets out of favour, yet again.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Wed, 09/10/2024 - 10:17

- Thu, 26/09/2024 - 15:45