Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The Bank of England last week moved to revive the UK economy through a cut in interest rates and a fresh bout of quantitative easing. The decision may or may not stave off a post-Brexit vote recession, but it will almost certainly inflict further damage on both defined benefit schemes and savers looking to buy an annuity.

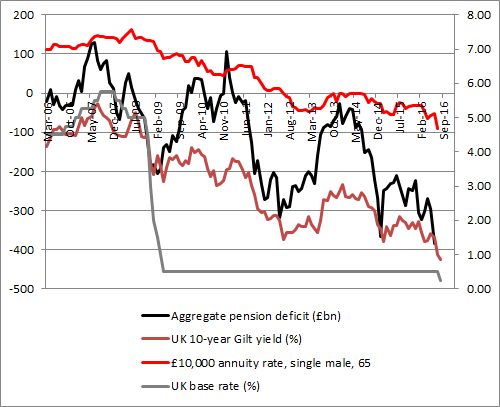

AJ Bell senior analyst Tom Selby looks at the chart that shows how pensions have been clobbered by a “perfect storm” of economic uncertainty, monetary policy shifts and rising life expectancy.

Source: Pension Protection Fund, Thomson Reuters Datastream & Billy Burrows

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Gilt yields – the journey to the bottom

“Gilt yields have plunged to historic lows in recent days, but their decline can be charted back to the first bout of monetary stimulus in the wake of the great financial crisis in 2008.

“The Bank of England’s decision to rapidly cut base interest rates to 0.5% and flood the market with hundreds of billions of pounds of quantitative easing – measures deemed necessary to avert economic Armageddon – inevitably forced yields downwards.

“Last week’s decision to slash the base rate to a record low of 0.25% and unleash a further £70bn of QE – another attempt to resuscitate the economy, this time following the Brexit vote - has seen yields deteriorate even further. The UK 10-year gilt yield hit a new low of 0.51% on Wednesday morning, and it remains unclear how long the base rate will remain at 0.25% or whether further monetary stimulus will be pursued.

“Much will depend on the extent to which the Bank of England’s dramatic intervention stokes inflation in the UK economy.”

How the Bank of England wreaked havoc with pensions

“Savers have unfortunately been caught in the crossfire of the Central Bank’s loose monetary policy over the past decade or so. Firstly, annuity rates – already on the decline as a result of improvements in life expectancy – have plummeted. This is because insurers use Government gilts to price annuity business, so when yields fall so do annuity rates.

“Defined benefit sponsors have also felt the pain of falling gilt yields, used to price scheme liabilities. While rising longevity, poor governance and lax regulation all had a part to play – as shown in the BHS disaster – the effect of the Bank of England’s monetary policy has been dramatic, as the chart above shows.”

The silver lining

“Ultimately there is no guarantee of how far or how fast the Bank of England will return to monetary policy tightening. Base rates and gilt yields could even fall further if economic growth and inflation remain stagnant – although in a debt-laden world it’s hard to imagine the Bank increasing borrowing rates to anything like the levels seen in the past.

“The silver lining is that the pension freedoms, introduced in April 2015, mean savers are no longer shoved towards buying an annuity at potentially rock-bottom rates. People can take control of their retirement savings more than ever before but they are going to have to think very carefully about how much they are paying in, the investment strategy they employ and the rate of withdrawals they can realistically take.”

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17