Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“America added 255,000 non-farm jobs in July and although this handsomely beat the consensus expectation of 180,000 the US Federal Reserve still has a dilemma on its hands when it meets to discuss interest rates on 20-21 September,” says Russ Mould, AJ Bell Investment Director.

“It has now had two positive jobs numbers in a row, although the May figure was particularly poor.

“However, the non-farm payroll data is a lagging indicator and the Fed did not move to tighten policy when job additions were running at well over 200,000 throughout 2014 and early 2015, so it is hard to see why it should decide to move now on the back of just two positive readings.

“It will also be well aware that the Bank of England, Bank of Japan and European Central Bank are all loosening policy. Even a whiff of a rate rise could send the dollar rocketing and put pressure on American economic growth.

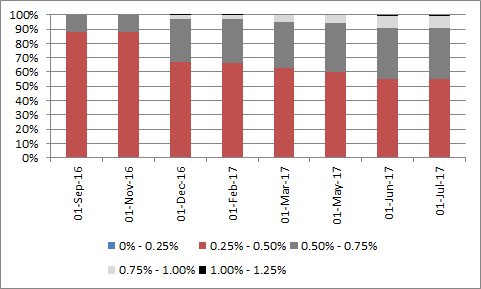

“The market seems unconvinced a rise is coming soon. Going into the non-farm payrolls numbers the CME FedWatch tool which tracks Fed futures markets, put only a 30% probability on one, solitary quarter-point rate hike by the end of the year – against the four the Fed was targeting in December 2016.”

Source: CME FedWatch tool

http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17