Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Confirmation that the Government wishes to sell its final 9% stake in Lloyds by next March will again have investors pondering whether the bank stock is suitable for their portfolios,” says Russ Mould, investment director at AJ Bell.

“Lloyds operates in a mature, well-regulated, competitive market that is unlikely to offer much by way of earnings growth. The Banks sector is still the very worst performer (out of 39) in the FTSE All-Share this year to date.

“Therefore, the bulk of total shareholder returns will probably have to come from the dividend yield rather than dramatic share price gains and capital growth.

“Lloyds has the potential to establish itself as an income stock at a time when many investors are hungry for yield. The bank paid out a 1.75p per share distribution in 2015, with a 0.5p special payment on top, and analysts expect increases in 2016 and 2017.

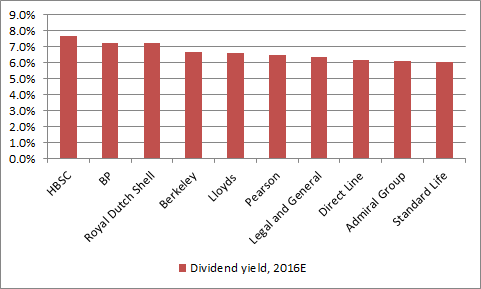

“Based on the consensus analysts’ forecast of a 4.44p dividend per share for 2016 and a share price of 68p, Lloyds is forecast to be the fifth-highest yielding stock in the FTSE 100 this year (see chart 1).

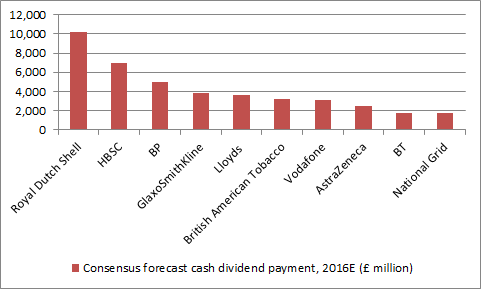

“It is also expected to be the fifth-highest payer of dividends in actual cash terms, at some £3.7 billion (see chart 2).

“The bank must therefore build a reputation as a reliable dividend payer and that it is becoming on old-fashioned, low-risk, utility-style bank.

“To do this, it needs to keep a lid on PPI and any other claims for misbehaviour, manage bad loans and impairments as best it can and hope the UK housing and mortgage markets remain healthy.”

Chart 1

Source: Digital Look, consensus analysts’ forecasts for 2016

Chart 2

Source: Digital Look, consensus analysts’ forecasts for 2016

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17