Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

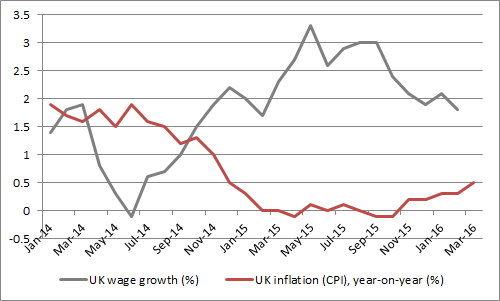

“A deceleration in wage growth to 1.8% suggest the Bank of England will feel no pressure to raise interest rates any time soon", says Russ Mould, AJ Bell Investment Director.

“The Office of National Statistics today revealed that UK unemployment rose by 11,000 in the three months to February, compared to the prior three-month period. This helped restrain wage growth to 1.8% for the December to February period, compared to 2.1% for November to January.

“Whether this is a blip ahead of the EU referendum on 23 June or a sign of a more profound slowdown in the UK economy remains to be seen, but the easing in wage growth could take a little steam out of the very modest increases we have seen in UK inflation this year.

“That in turn suggest the Bank of England is unlikely to rush to raise interest rates any time soon, even if the headline borrowing rate has been anchored at a record-low of 0.5% since March 2009.”

Source: ONS

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17