Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

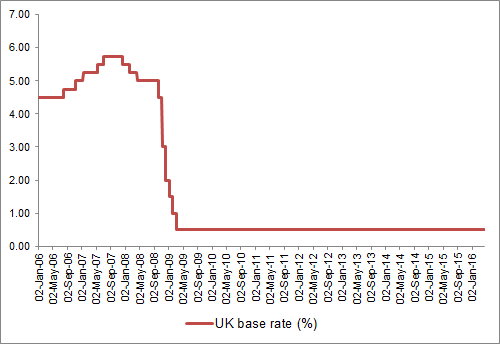

The headline UK interest rate has remained hooked to the floor for 86 months, since March 2009, and despite an encouraging rise in inflation this month, it does not seem likely to increase very soon or very quickly for three reasons:

- Firstly, a move above the Bank’s 2% inflation target would be seen as a lesser evil than a slide back towards deflation.

- Secondly, inflation would erode the value of the UK’s enormous aggregate public debt in “real” terms.

- Finally, any sudden rate hike could prompt a rally in the pound which could stifle exports and thus economic growth, as well as inflation as it would lessen the cost of imports.

Source: Bank of England

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term

These articles are for information purposes only and are not a personal recommendation or advice

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17