Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

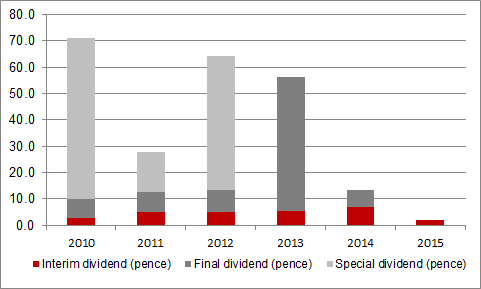

“A decision to pass on its final dividend and cut its 2015 annual payout from 13.5p to 2.0p, is putting renewed pressure on shares in copper miner Antofagasta today and takes the total in dividend cuts announced by FTSE 100 firms for 2015 and 2016 to more than £5.7 billion" says Russ Mould, AJ Belll Investment Director.

“This move by Antofagasta represents a stunning change from the glory years of 2010, 2011 and 2012 when it paid out three special dividends worth a total of 127p per share, an enormous number compared to today’s 486p share price and one that shows how the mining industry’s fortunes have changed as commodity prices have tumbled.

“Antofagasta’s dividend came to around £133m in 2014 but just £20 million in 2015 and this reduction takes the total amount of cuts announced by FTSE 100 firms for 2015 and 2016 to over £5.7 billion.”

Source: Digital Look, Company accounts, AJ Bell research

This includes Morrisons which returns to the FTSE 100 index later this month after the latest reshuffle.

This excludes Tullow Oil which cut dividends when it was in the FTSE 100 and has since been ejected.

Severn Trent has only published interims; the full-year figure is based on consensus estimates

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17