Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

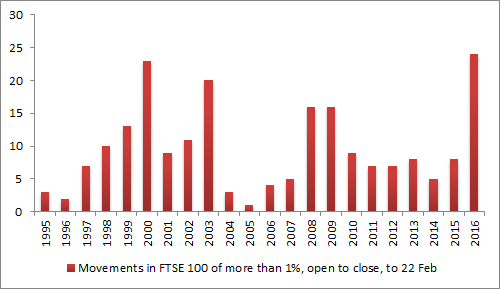

In just 36 trading days this year, the FTSE 100 has risen or fallen by more than 1% from open to close on 24 occasions, the most in any year going back to at least 1995 – and that is before any further uncertainty created by the run up to the EU referendum on 23 June.

The only years which come close to this figure are 2000, 2003, 2008 and 2009, which saw 23, 20, 16 and 16 such movements respectively.

The bad news is 2000 and 2008 live in investors’ memories for the wrong reasons. The FTSE 100 fell 10% in 2000 as the technology-led bull run in stocks came to an end and a three-year bear market began, while the index plunged 31% in 2008 as the financial crisis reached its zenith.

Source: Thomson Reuters Datastream, AJ Bell Research. Covers period from 1 January to 22 February in each year

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

“History is not guaranteed to repeat itself but this sort of volatility unfortunately tends to be a bad sign rather than a good one. Markets tend to do best during periods of calm and less well when share prices are whipsawing around. says Russ Mould, AJ Bell Investment Director

“The good news is that 2003 and 2009 both saw the end of long bear markets as the FTSE 100 found its footing and embarked upon fresh gains.

“This year has already seen 12 open-to-close movements of 2% or more and seven of those have been declines against five increases, so those investors tempted to buy on the dips will be hoping this year’s action is similar to the final capitulation selling witnessed in 2003 and 2009 before markets started to head north again.”

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17