Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The slide in the Institute for Supply Management’s (ISM) non-manufacturing sentiment survey is a nasty surprise for those who remain convinced the US economy is firing on all cylinders and incapable of tipping back into recession" says Russ Mould, AJ Bell Investment Director.

“A reading of 53.5% for January represented a decline from 55.3% in December and comfortably undershot the consensus forecast of 55.1%.

“The details behind the headline figure also offered little comfort. New orders fell from 58.9% to 56.5% and the employment indicator from 56.3% to 52.1% and – to fuel markets’ fears of deflation – the prices index tumbled from 51% to 46.4%.

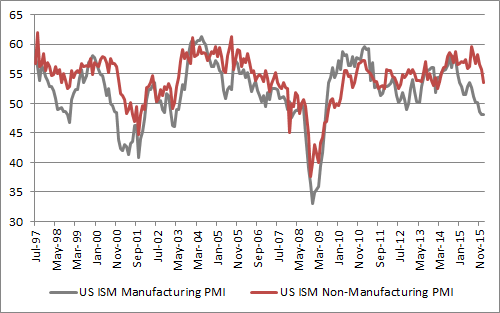

“Bulls had argued that softness in the equivalent manufacturing survey would not matter, even though the reading here has sat below 50 for three months and reached six-year lows, asserting that consumer spending and leisure activity would take up the slack regardless.

“Yet a study of the long-term history of the two ISM surveys shows that once manufacturing starts to swoon, non-manufacturing always follows in the end (see chart).

“This will only add to concerns the US Federal Reserve made a mistake by raising rates in December and that the American economy is losing momentum – and fast.”

Source: Thomson Reuters Datastream

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17