Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Four further quarter-point increases in US interest rates this year is starting to look extremely questionable, in light of financial market volatility, the ongoing commodities rout and the very mixed nature of US economic data" says Russ Mould, AJ Bell Investment Director.

“Although the non-farm payrolls numbers remain healthy, jobs figures are a lagging indicator. Concurrent indicators like retail sales, industrial production and durable good orders continue to disappoint while lead indicators like purchasing managers indices, at national and local level, are still sliding.

“Any further market falls or weak data could even shift the outlook away from whether the Fed will tighten policy to whether it will start loosening again.

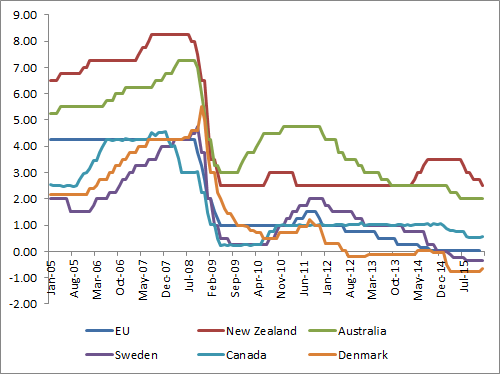

“A study of other countries who have tried to raise interest rates since the Great Financial Crisis suggests this prospect cannot be dismissed out of hand, embarrassing as it would be for the Fed.

“Sweden, New Zealand, Australia, Canada, Denmark and the European Union have all raised rates since 2009 and, without exception, all have ended up cutting them again, as their currencies have soared and economies slowed.

“Dollar strength may well weigh upon the Fed’s calculations and the Atlanta Fed GDP Now forecast is for Q4 growth of just 0.6%, well below consensus, so Yellen and her team have much to ponder this week, especially as share and commodity prices have gone into a tailspin since December’s rate hike.”

Source: Thomson Reuters Datastream

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17