Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Reported GDP growth of 6.9% in China during 2015 represents a marked slowdown from previous years and is therefore unlikely to calm Western market fears about two things" says Russ Mould, AJ Bell Investment Director.

“First, if China is slowing down, it raises the question of whether the authorities will be tempted to let the renminbi slide yet lower, giving a boost to Chinese manufacturers but potentially exporting deflation to the rest of the world.

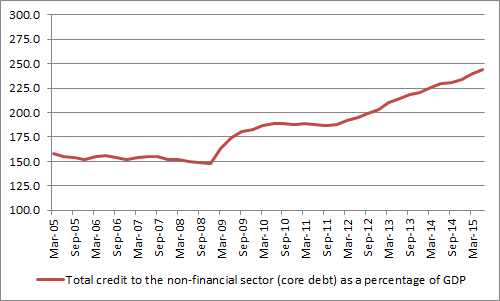

“Second, any Chinese slowdown only points to the elephant which is still in the room, namely debt. This isn’t just a Chinese problem, it is a global one, but core Chinese debt (loans to the non-financial sector) has mushroomed from 187% of GDP to 244% of GDP since the end of the great financial crisis in 2009, (see Chart). This suggests a lot of the recent growth is based on the potentially wobbly foundations of ever-more borrowing, something which has now well and truly caught up with us in the West.”

Source: Bank of International Settlements, December 2015

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17