Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Sainsbury’s (LSE:SBRY) 0.4% drop in like-for-like sales in its fiscal third quarter is another upside surprise from the food retailing sector following on from Morrison (LSE:MRW) yesterday and the improved momentum is likely to be welcomed by the market, says Russ Mould, AJ Bell Investment Director.

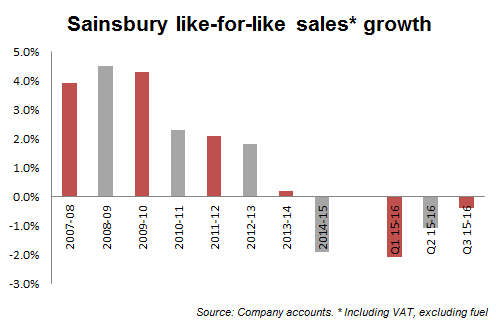

“The grocery giant now benefits from having to beat a low set of expectations (see chart) – something which also favoured Debenhams (LSE:DEB) and Morrisons this week, in contrast to Next (LSE:NXT) and Marks & Spencer (LSE:MKS) last week, where the bar had been set higher and the shares suffered as a result.

“Sales growth of 5% in general merchandising and 6% in clothing piles further pressure on M&S’ incoming boss Steve Rowe to deliver the goods here when he takes over in April, especially as Debenhams also surprised positively yesterday.

“Meanwhile Sainsbury’s boss Mike Coupe admits pricing in food means that market remains challenging, which is little surprise after Asda’s latest price-cutting initiative this week.”

Source: Company accounts. * Including VAT, excluding fuel

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17