Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“As the Federal Open Market Committee starts its deliberations today, global stock markets are so expectant of the first interest rate increase for 10 years that any failure to act is likely to do more damage to market sentiment than any hike in borrowing costs,” says AJ Bell investment director Russ Mould.

“Chair Janet Yellen will be well aware that equities fell sharply after the surprise decision to do nothing at the September Fed meeting. If she decides to leave interest rates unchanged, then the markets could easily take fright again, in the view she must know something about some problem, somewhere of which investors are ignorant.

“History also suggests that markets would be almost relieved to see the Fed get on with it.

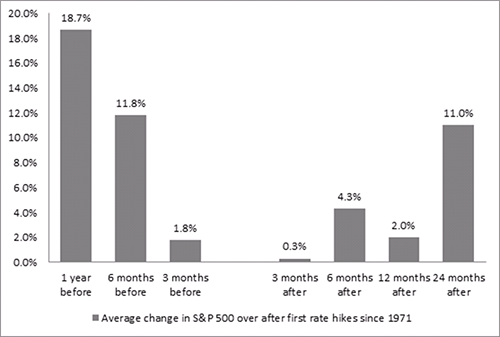

“A study of interest rate increase cycles since 1971 shows that the S&P 500 does worst on average going into and coming out of the first increase in headline borrowing costs in a new cycle (see Chart).

“Any decision by Yellen to hold fire could be interpreted as a sign of concern over the underlying strength of the US economy and that is unlikely to be well received by markets.”

Source: Thomson Reuters Datastream / AJ Bell research

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17