Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Prudential’s shares are down by a third over the past year and languish at 12-year lows, dragged down by markets’ disappointment with how the economies of Hong Kong and China are failing to show markedly improved momentum after the conclusion of their lengthy lockdowns imposed because of covid-19.

After the spin-offs of London-headquartered fund manager M&G in 2019, a major fundraising in Hong Kong in 2021 and the demerger of America’s Jackson Life in 2022, Prudential is now a play on demand for financial services in Asia and Africa. The firm is a leader in savings and health and protection products, and has a strong distribution network for bancassurance too (where banks sell insurance products). Prudential’s long-term strategy is to position itself for both population growth as well as increased prosperity and the rise of the middle class, as this is potentially the sweet spot for increased demand for financial products and services.

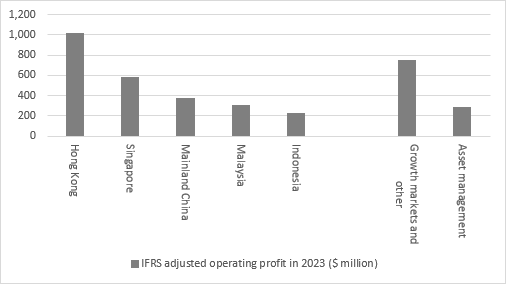

Note that in 2022, Hong Kong was Prudential’s most profitable market, followed by Singapore, Mainland China, Malaysia and Indonesia, while the firm has identified India, Vietnam, Thailand, Taiwan and the Philippines as what it calls high growth markets.

Source: Company accounts

- Following his arrival just over a year ago, chief executive Anil Wadhwani undertook a review of Prudential’s operations and strategy. As a result, he laid down two new financial objectives:

- New Business Profit (or NBP) compound growth of 15% to 20% between 2022 and 2027.

- Double-digit percentage compound growth in operating free surplus from the in-force insurance and asset management businesses between 2022 and 2027.

- This set of first-half results for 2023 will be the first step along that path and this set of figures will be judged in that context. After that, analysts and shareholders will assess four near-term metrics to gauge whether the results are good, bad or somewhere in the middle – the share price suggests expectations are low and little or no near-term growth is expected across key business lines.

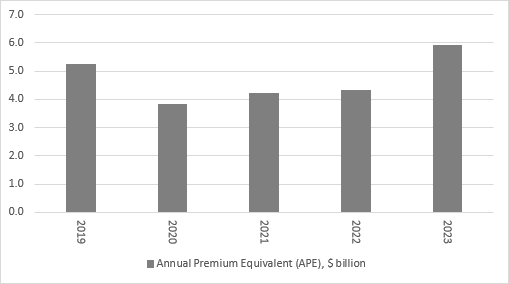

- The first is APE, or Annual Premium Equivalent. This is the sum of the initial premium on new annual-premium policy sales plus one-tenth of premiums on new, single-premium policies. This is a measure of new business written and in 2023 Prudential’s APE figure grew by 37% to $5.9 billion. In the first quarter of this year, as per April’s trading update, APE grew by 7% on a constant currency basis, and 4% in stated terms, thanks to a tough base for comparison in Hong Kong and China and a slowdown in Vietnam.

Source: Company accounts. Based on continuing operations only. IFRS17 accounting standard introduced in 2023 so prior numbers may not be directly comparable

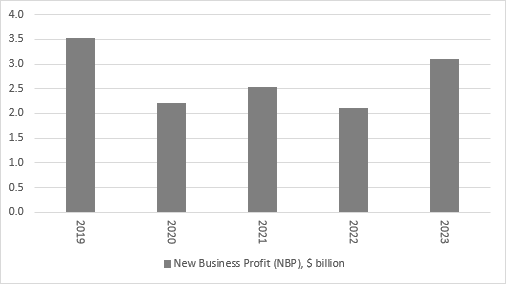

The second is New Business Profit (or NBP). In 2023, this surged by 45% to $3.1 billion. In the first quarter of 2024, NBP came in flat on a constant currency basis and fell 2% on a stated basis, although management tried to steer the market toward a headline figure ‘excluding economic impacts,’ which offered 11% growth on a constant currency basis.

Source: Company accounts. Based on continuing operations only. IFRS17 accounting standard introduced in 2023 so prior numbers may not be directly comparable

The third is operating profit, as recognised under the statutory IFRS17 accounting regime. On an adjusted basis, the benchmark here is the $2.9 billion earned in 2023, an 8% advance compared to 2022.

Source: Company accounts. Based on continuing operations only. IFRS17 accounting standard introduced in 2023 so prior numbers may not be directly comparable

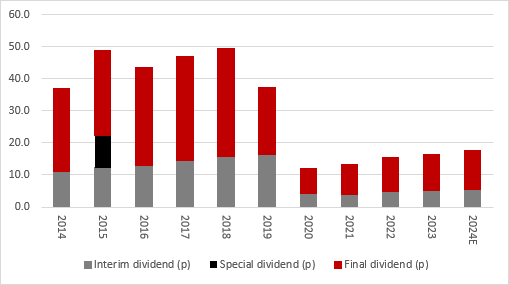

The final key yardstick is the dividend, where Prudential has declared its distributions in dollars since its full-year results for 2019, after the M&G spin-off, which reduced the stand-alone pay-out from the parent. In 2023, Prudential paid out 20.47 US cents (or 16.5p) a share. For 2024, analysts are expecting a 6% increase to the equivalent of 17.5p a share and the benchmark from the first half a year ago is 6.26 US cents, or 5.16p a share.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

As a final point, Prudential launched a $2 billion share buyback programme in June, with target completion date of mid-2026. That represents around 9% of the company’s current stock market capitalisation and supplements the 2.8% yield implied by the forecast 17.5p-a-share dividend.

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17