Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Shares in Tesla have gone into overdrive this month. A 33% share price increase saw the company’s stock market valuation grow by $209 billion in just the first eight trading days of the month, a sum that exceeds the aggregate stock market value of Europe’s Mercedes-Benz, Volkswagen and Stellantis ($198 billion),” says AJ Bell AJ Bell investment analyst, Dan Coatsworth.

Quite what inspired this romp is hard to divine, barring ongoing investor enthusiasm for companies that are perceived as AI (and autonomous driving) plays, Elon Musk’s courtroom victories at Tesla and X and ongoing hopes surrounding the Cybertruck, the supercharger network and the ride-hailing app.

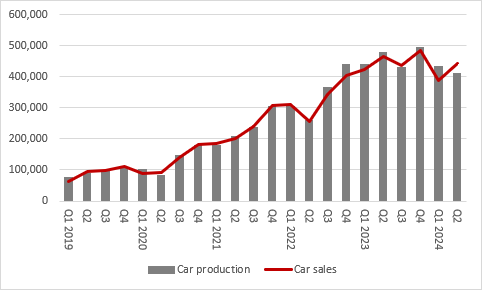

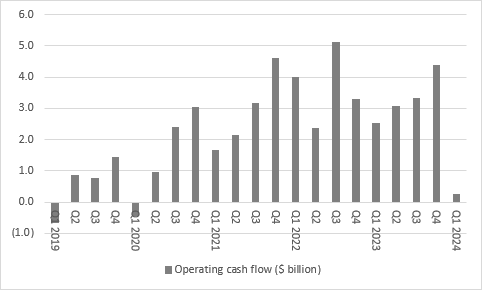

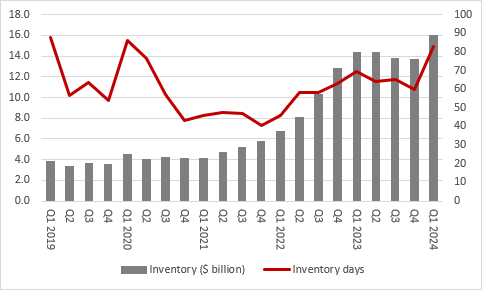

It certainly cannot be the first-quarter results – which offered the lowest three-month profits since Q2 2021, a shrivelling of cash flow and a surge in inventory – or the second-quarter production and delivery numbers released earlier this month. They showed a 14% year-on-year drop in car production and a 5% drop in unit sales, although at least that may have helped to work down some of that inventory.

Source: Company accounts

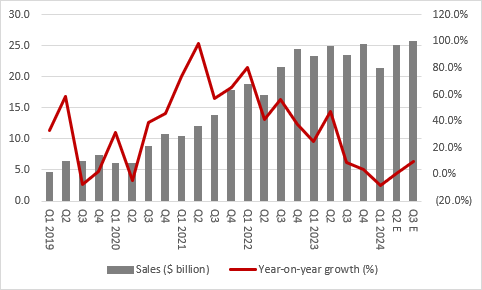

At least unit sales rose compared to the first quarter and that informs analysts’ second-quarter revenue forecast of $25.1 billion, 18% higher than in the January-to-March period and broadly flat year-on-year. For the third quarter, the current consensus is sales of $25.7 billion and that would signify a return to growth in the top line of some 10% year-on-year.

Source: Company accounts

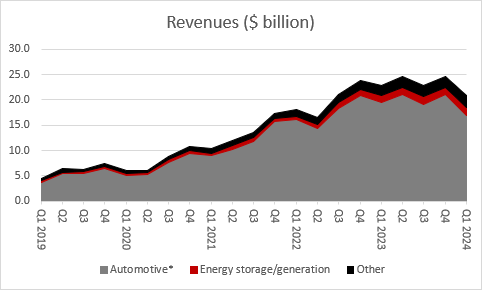

Analysts and shareholders will also look to the mix of revenues, where energy storage, energy generation and other business lines accounted for 19% of the total figure in the first quarter of 2024, compared to 10% in the first quarter of 2022 two years ago.

Source: Company accounts. *Includes regulatory credits and auto leasing

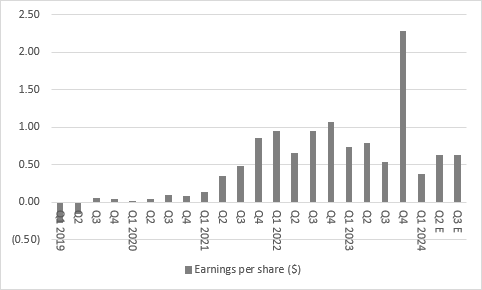

The headline earnings per share (EPS) figure slumped to $0.37 in Q1, but the analysts’ consensus is looking for a rebound to $0.62 in Q2, even if that still represents a one-third drop from the outcome in the equivalent period a year ago. For Q3, the consensus EPS forecast is $0.63.

Source: Company accounts. Q4 2023 benefited from a $5.8 billion tax credit

Tesla carries a net cash pile of $21.5 billion so a quarter or two of weak cash flow is not of undue concern, although shareholders will look for improvement here, not least as it would signify both higher profits and also a cleaner balance sheet through the reduction of inventory.

Source: Company accounts

Inventory rose by 12% year-on-year in Q1 (and receivables jumped by 30%) even as sales fell, with the result that inventory reached a record $16 billion and inventory days soared to 83 days, the highest mark since the pandemic-blighted first quarter of 2020.

Source: Company accounts

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17