Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The failure of energy suppliers such as bulb, ampower, igloo, Hub Energy and many, many more has caused great distress to many households, but a lot of them have been able to get help from Utility Warehouse, whose parent is Telecom Plus,” says AJ Bell investment director Russ Mould.

“As a result, the FTSE 250 firm is looking forward to healthy further customer and profit increases in the year to April 2024, even after a record twelve months just ended.

Source: Company accounts. Fiscal year to March

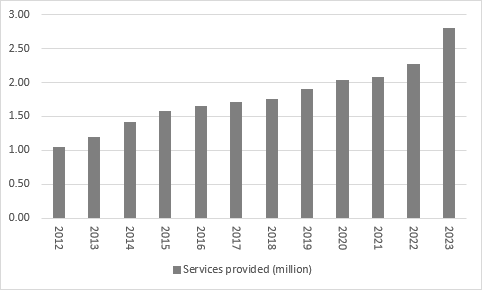

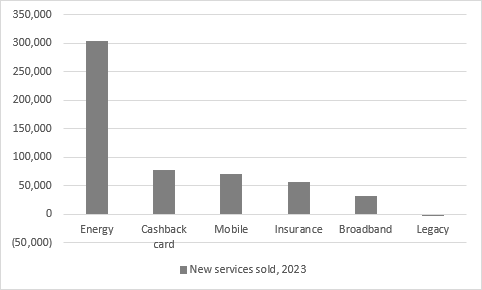

“Utility Warehouse is a multi-service provider that offers broadband, mobile and insurance, as well as energy and it is successfully cross-selling to new customers, too, as they seek savings wherever they can get them.

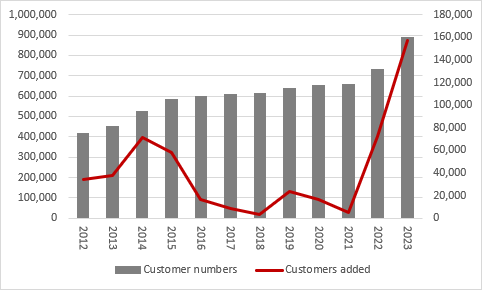

“Telecom Plus added 158,000 customers in the fiscal year that has just ended and provided 530,000 more services.

Source: Company accounts. Fiscal year to March

“Energy was understandably the key driver here, but customers also signed up for mobile, insurance and broadband, while only the legacy wireline telecoms business showed a drop. The insurance business in particular seems to be gaining traction, given how customer numbers more than doubled to 100,590. The creation of in-house insurer UWI is the next step here and, after receiving regulatory clearance, the unit wrote its first policies in April 2023.

Source: Company accounts. Fiscal year to March

“Sales are done by Partners and word of mouth, with nothing spent on advertising, so a 25% increase in Partner numbers to nearly 60,000 provides a good base for future growth.

“Another competitive advantage enjoyed by the firm is its longstanding, long-term energy supply deal with E.On (npower, back in the day), whereby the German utility carries the risk of buying and sourcing the energy. Although the reduction in the Ofgem Price Cap will reduce revenue per customer and perhaps lessen the need to switch supplier in the near term, a market where there is no need for regulatory intervention and one where price deals can be offered could again reinforce the strategic value of the E.On relationship.

“The strong customer additions in fiscal 2023 help to underpin the bullish goals laid down by co-CEO Andrew Lindsay alongside the 2022 full-year results, when he laid down a target of adding one million customers by March 2027. After one year, the company has 158,000 of those already signed up, fewer rivals left in the energy business and the E.On supply deal as a major competitive advantage with only 2% of UK households currently taking a service from the group.

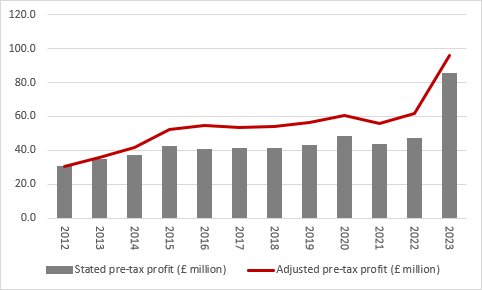

“The robust growth in customers and service provision is helping to drive sales and cash flow. Adjusted pre-tax profit surged to £96.2 million from £61.9 million in fiscal 2022 and this was achieved even though bad debt write-offs more than doubled to £28.7 million (or 1.6% of annual sales). Co-CEOs Andrew Lindsay and Stuart Burnett have targeted a double-digit percentage increase for the twelve months to April 2024.

Source: Company accounts, Marketscreener, analysts’ consensus forecasts. Fiscal year to March

“That boost to profits is driving cash flow and cash flow pays dividends, especially at firms like Telecom Plus where the firm has a net cash position of £103 million. Even if this is flattered by £121 million in advance cash payments from the government as part of its energy support schemes, the balance sheet is very solid.

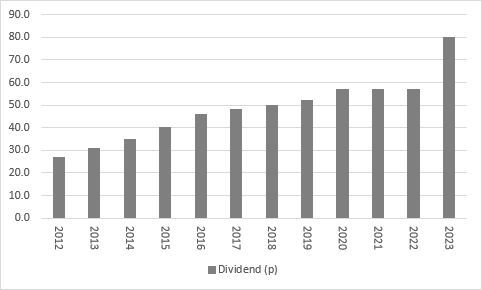

“The dividend is going to 80p a share from 57p in 2022 and Mr Lindsay and Mr Burnett are targeting further increments – and possible share buybacks – going forward. The historic dividend yield is 4.8% and that may catch the eye of income seekers, especially as the distribution may grow again going forward.

Source: Company accounts

“It is not all plain sailing, however. Profit margins fell, to reflect the increase in energy prices and also the mix shift in customers toward lower-margin energy services, and that increase in bad debts must be watched. The company will be on the alert for signs that customers are struggling to pay, or at least cutting consumption of power in order to save money, as they wait to discover what the next stage of the government’s Energy Price Guarantee will look like.

“Nevertheless, customer churn looks low and acquisition rates impressive, thanks in part to the lack of viable options in the energy market, and the profit and dividend forecast upgrades suggest that Telecom Plus feels it is well positioned to help consumers through this extraordinarily difficult period, while keeping regulators sweet at the same time.

“The biggest question with which investors may therefore have to wrestle is the share price, which is lurking near one-year lows, despite all of the good news. The yield looks attractive but using the adjusted historic earnings per share (EPS) number of 99.2p, the shares trade on 17 times historic earnings, a big premium to the wider UK equity market which trades on 13 times historic earnings and nearer 11 times forward earnings for 2023.

“The reason for the one-third share price fall from the winter peaks may be as much one of valuation as the effect of falling energy prices and government support schemes. At its highs Telecom Plus traded on multiples of earnings that represented a huge premium to the UK market and priced in an awful lot of good news. The combination of the share price drop and rapid earnings growth means the valuation premium is now lower and – perhaps in the eyes of some, judging by gains in the wake of the results – easier to justify.”

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17