Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“America’s S&P 500 stands at a new twelve-month high, as tech stocks, and hopes for a shallow recession (or even no recession at all) and a peak in interest rates carry the index onwards and upwards. But the benchmark may need better breadth if it is to kick on and challenge its closing all-time zenith of 4,797 on 3 January 2022,” says AJ Bell Investment Director Russ Mould.

“Just six stocks – Alphabet, Amazon, Apple, Meta, Microsoft and NVIDIA have generated 88% of the S&P 500’s $3.8 trillion gain in total market capitalisation in 2023 and such a reliance upon a select list is usually a bad sign, not a good one.

Source: Refinitiv data

“If anything were to unexpectedly go wrong at any of those six, then that could hold back the index. Those who follow Warren Buffett’s dictum that, ‘You cannot buy what is popular and do well,’ may also be forgiven for feeling a little nervous that the US market is going down a similar path to the one taken in the early 1970s, when the Nifty Fifty were seen as similarly indestructible, only to prove eminently sinkable as inflation and earnings disappointments meant their lofty valuations proved unsustainable.

Source: Refinitiv data. MAANAM = Meta, Alphabet, Apple, NVIDIA, Amazon and Microsoft

“To rely on those six stocks alone could also bring dangers in terms of valuation. The sextet’s aggregate market cap is $9.9 trillion when forecast aggregate earnings in 2023 are expected by analysts to reach $295 billion. That is 33 times earnings, a rating which prices in a lot of future potential and leaves little margin for error should there be a stumble.

“However, the good news may be that the S&P’s breadth is improving, at least a bit. In June, the index has added $780 billion in market cap and the Big Six have chipped in ‘only’ one-third of that.

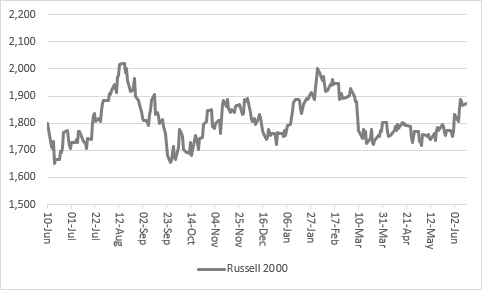

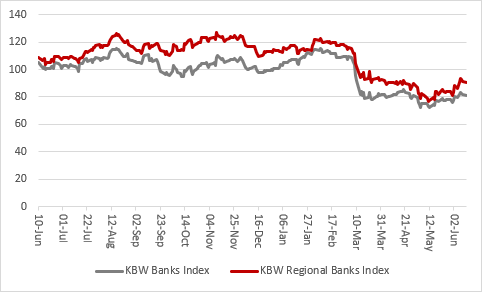

“US equity investors may look to draw encouragement from how small caps (and by implication ‘value’, rather than out-and-out growth, names) are showing signs of life, as are the banks.

Source: Refinitiv data

“Some sign of recovery in the lenders – big and especially regional – would be particularly welcome, especially after spring’s carnage when three of America’s biggest banks by assets went to the wall in quick succession. A good performance here would help to reassure that the failed banks were indeed just badly run outliers, rather than indicative of wider problems related to too much debt and too little growth, even if the jury is still out on both counts.

Source: Refinitiv data

“If small-caps and banks – or ‘value’ for want of a better turn of phrase – catch light then the US market could perhaps confound the doubters and keep going up, up and away, but the more the S&P 500 relies on a tiny handful of names to do the heavy lifting the greater the risk and the less the potential reward, especially given the valuations already attributed to the Big Six.”

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17