Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The company can adjust, rebase and try to flatter its reported figures all it wants, but the share price fall shows the FTSE 100 firm isn’t fooling anyone, and that is because there are three glaring flaws in new Vodafone boss’ Margherita Della Valle’s plan to return Vodafone to investors’ favour,” says AJ Bell Investment Director Russ Mould.

“First, the strategy focuses on ‘Customers, Simplicity and Growth,’ but growth is not a strategy – it is what results from strategy. Second, there is no growth, as Vodafone is steering down profit and cash flow guidance for the new fiscal year and declares another unchanged dividend. Finally, the company still looks like an over-indebted investment trust of telecoms assets and the new CEO’s plan does nothing to address the structural challenges that face Vodafone, as it tries to compete on too many fronts, in too many markets with too little resource, thanks to its hefty borrowings.

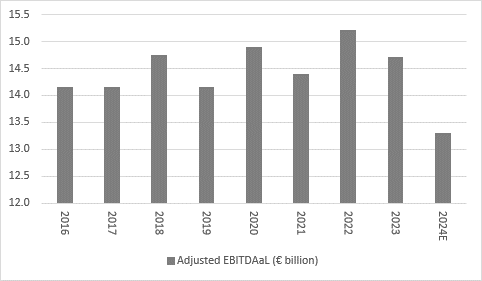

“Vodafone effectively tries to mark its own homework by preferring the unusual profit metric of uEBITDAaL, which stands for underlying earnings before interest, taxes, depreciation, amortisation and lease expenses. In plain English means ‘earnings before lots of bad stuff’ and even then, it is struggling to meet, let alone beat, its targets. In the year to March 2023, uEBITDAaL came in at €14.7 billion, below the €15.0-15.2 billion targeted by management in November (and that in itself was a downgrade from the guidance of €15.0-15.5 billion given a year ago). Even allowing for currency movements and changes to group structure, the preferred profit yardstick came in lower than expected at €14.9 billion.

“Worse, for the new year, Vodafone is guiding to €13.3 billion, which it says is flat on a like-for-like basis against fiscal 2023.

Source: Company accounts, Marketscreener, management guidance for 2024E. Fiscal year to March

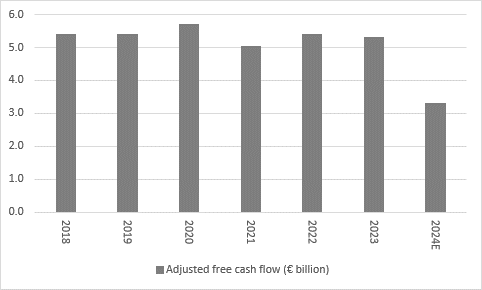

“The profit measure may be flat but Vodafone expects adjusted cash flow to shrink in the coming year to €3.3 billion, from €4.8 billion on a like-for-like basis (and 2023’s actual outcome of €5.3 billion).

Source: Company accounts. Fiscal year to March

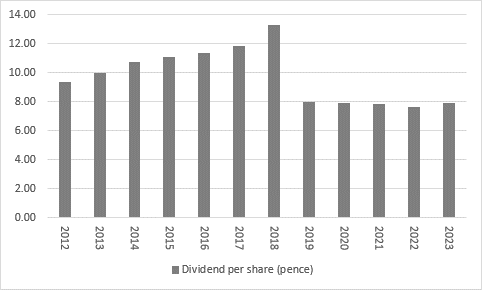

“Given the twin burdens of paying interest and maintaining or building out networks, the combined cost of which came to €8 billion, it is no surprise cashflow is under pressure and that in turn is limiting Vodafone’s scope to rebuild its dividend after 2018’s cut. The company has declared an unchanged payment of €0.09 for the full year.

Source: Company accounts. Fiscal year to March

“The news is not all bad, however. Debt is coming down, thanks in part to the sale of assets.

“The new CEO acknowledges clearly that performance is not good enough and that the company is perhaps fighting on too many fronts. The results statement and presentation both flag the markets where Vodafone is performing strongly and creating value for shareholders and those where it is not, the latter due to competition, regulation and local management performance. Ms Della Valle flags Turkey, Portugal, Ireland, the Czech Republic, South Africa and Greece as areas that are doing well. The bad news is that the firm’s biggest markets – the UK, Germany, Spain and Italy – are not performing as hoped or needed, so there is much work to be done. This may explain why chatter about a merger in the UK between Vodafone and Three refuses to go away, although shareholders will want to assess the terms of any such transaction and see what Vodafone owns after any deal, given that the overall group’s structure is already complex enough as it is.

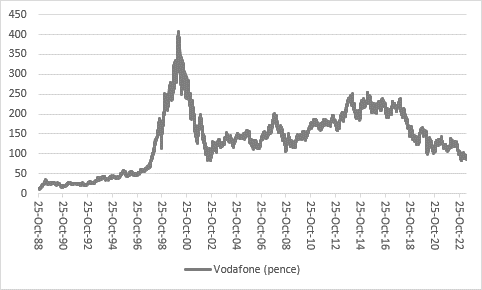

“Finally, expectations are very low, so it may not take too much to surprise on the upside. Vodafone’s latest share swoon takes the price back to levels no higher than those of 2002 when the tech, media and telecoms bubble had burst and Vodafone was weighed down by the debts accumulated thanks to a major acquisition in Germany, although on that occasion the purchase was Mannesmann, and not Liberty Europe’s cable assets, as is the case now.”

Source: Refinitiv data

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17