Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Questions will be asked about the structure of 2012’s long-term incentive plan, the riches it bestowed upon management and how shareholders let it through on the nod, but Persimmon has gone a long way to calming at least one unhappy party by showering investors in the stock with a cash windfall of their own,” says AJ Bell Investment Director Russ Mould.

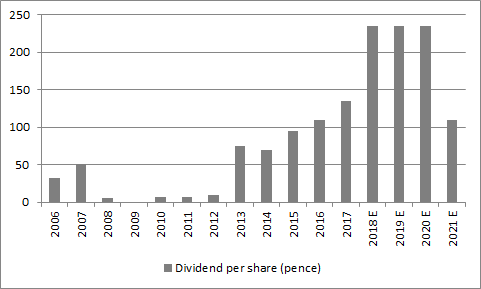

“Persimmon has hugely enhanced its cash return plans, adding a 125p-a-share interim dividend to the already-planned 110p-a-share annual payout. That makes 235p a share per year for the next three years, enough for an 8.4% dividend yield even after the initial share price jump today.

Source: Company accounts. Forecast figures based on guidance given in today's results statement.

“That makes Persimmon the second-highest yielding house building stock, based on its 2018 plan and consensus forecast for its peers.

| 2018E | Historic | |||

| PE (x) | Dividend yield (%) | Dividend cover (x) | Price/NAV(x) | |

| Bovis | 11.9 x | 9.0% | 0.94 x | 1.52 x |

| Persimmon | 10.6 x | 8.4% | 1.11 x | 2.81 x |

| Taylor Wimpey | 9.3 x | 7.7% | 1.39 x | 2.31 x |

| Barratt Developments | 8.8 x | 7.7% | 1.49 x | 1.32 x |

| Crest Nicholson | 7.0 x | 7.3% | 1.96 x | 1.72 x |

| Berkeley Homes | 11.2 x | 5.2% | 1.73 x | 2.54 x |

| Bellway | 7.7 x | 4.3% | 3.04 x | 1.81 x |

| Redrow | 7.5 x | 4.0% | 3.34 x | 1.76 x |

| Countryside Properties | 9.3 x | 3.4% | 3.20 x | 2.28 x |

| AVERAGE | 9.2 x | 6.3% | 2.02 x | 2.01 x |

Source: Digital Look, consensus analysts' forecasts.

“It also makes it the highest-yielding individual stock in the FTSE 100, based on its 2018 plan and consensus forecast for its peers.

| 2018 E | ||

| Dividend yield (%) | Dividend cover | |

| Persimmon | 8.5% | 1.09 x |

| Centrica | 8.2% | 1.24 x |

| SSE | 7.8% | 1.26 x |

| Barratt Developments | 7.7% | 1.49 x |

| Taylor Wimpey | 7.7% | 1.41 x |

| Direct Line | 7.3% | 1.12 x |

| Imperial Brands | 7.1% | 1.49 x |

| BT | 6.7% | 1.73 x |

| Vodafone | 6.6% | 0.70 x |

| Lloyds | 6.5% | 1.62 x |

Source: Digital Look, consensus analysts' forecasts.

“This will doubtless attract income-seekers, especially as concerns still linger over the prospective payout at Centrica, for example.

“In addition, Persimmon’s increased cash returns are a clear sign of confidence in its own financial strength, given its £1.3 billion net cash pile, low customer cancellations and a forward sale book of some £2 billion.

“However, this is not to say that buyers should plough blindly into Persimmon, even if the management team is doing its best to placate shareholders and maximise returns from the housing market, which continues to benefit from Government support in the form of the Help-to-Buy scheme and the Lifetime ISA.

“While all looks good now, there are still concerns to address. After all, UK mortgage approvals fell 9% year-on-year in December to 61,039, the lowest figure since January 2015, and house price growth has begun to ease, in the wake of the Bank of England’s first interest rate hike in a decade, concern over weak wage growth and soggy consumer confidence.

“Income-seekers must therefore ask themselves three questions, just to make sure:

- “What chance is there of a housing downturn at all? A forward PE of barely 11 suggests investors are still wary of paying too high a price to access Persimmon’s earnings and cash flow streams, for all of the excellent near-term visibility.

- “What would happen if there is a housing downturn – unlikely as it seems at the moment – in terms of profits and therefore dividend cover?

- “In the event of a deep downturn Persimmon probably could hold those 235p dividends by using up its cash pile here rather than to buy land – but buying land cheaply is what makes the builders tick in the long run, so that could be a big strategic call if push came to shove: would management stick with the dividend and sacrifice land buying, even if it can comfortably sanction both at the moment.”

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17