Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“BP’s best operating profit since early 2014 and the resulting huge improvement in cash flow are both helping to drive the oil major’s shares towards a five-year high as investors welcome the support the third-quarter earnings figures show for the company’s tempting dividend yield,” says AJ Bell Investment Director Russ Mould.

“Based on consensus’ analysts forecasts for an unchanged full-year 2017 dividend of $0.40 per share (around 30p a share at current exchange rates) BP is the third biggest dividend payer overall within the FTSE 100 and offers the eighth-highest yield at 6.1% - a figure which is likely to outstrip anything available on cash for some time to come, regardless of what the Bank of England does or says on Thursday.

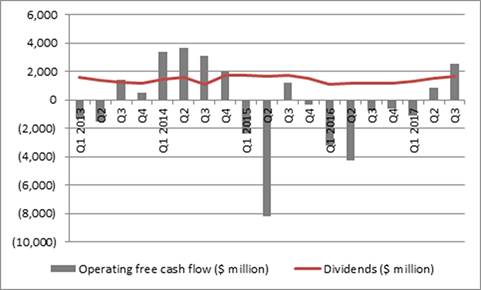

“Investors will therefore be delighted to see cash flow of $2.5 billion easily cover dividend payments of around $1.6 billion – and the cover ratio of 1.5 times is the best since Q3 2013, when the oil price was hovering around $90 a barrel.

Source: Company accounts

“Operating profit reached $3.5 billion in the quarter, compared to $1.8 billion a year ago, as BP’s deep cost cuts ensured the major made the most of increased oil prices. Group production rose 10% to 3.6 million barrels of oil equivalent per day, average gas prices rose 4% year-on-year, average Brent crude prices rose 14% year-on-year and unit production costs fell by 16%.

“The upstream (oil exploration and production operations) made a replacement cost profit of $1.2 billion, the best showing since late 2014, and downstream (refining, petrol stations and lubricants) made more than $2.2 billion in the third quarter, something which should please holders of Shell, as the Anglo-Dutch giant also draws a big chunk of its profits from downstream businesses.

“All of this leaves BP well placed to maximise the benefit of oil’s return to the $60-a-barrel mark, should this prove sustained, but today’s numbers offer encouragement even if they do not.

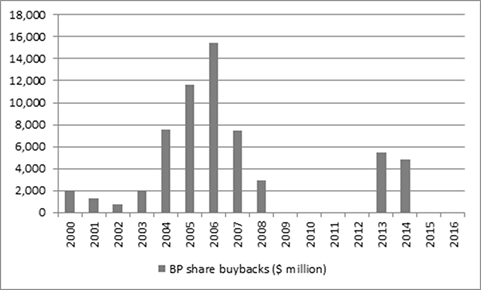

“The only small cloud, for the moment, is BP’s decision to resume share buybacks – just as the shares reach their highest level in nearly five years. The company justifies this move by saying it will only buy back stock to cover the dilution to existing shareholders which results from the payment of dividends in scrip (new shares) rather than cash – and had those dividends been paid in cash the result would have been a cash outflow anyway.

“However, it seems a little strange to start now, after the shares have rallied by nearly 60% from their 2015 lows.

“BP last bought back stock in 2013-14, when oil was nearer $100 a barrel and its shares last consistently traded near 500p. Before that, buybacks peaked in 2005-2006 when its shares traded between 500p and 700p.

Source: Company accounts

“BP’s website shows that the firm has spent $61.4 billion on share buybacks since 2000 but its share price now is lower than it was 17 years ago, so prior management teams’ records at judging when to buy back stock look poor.

“Nor is it clear that BP fully meets the criteria laid down by investment legend Warren Buffett for buybacks – namely that a company has ample funds to take care of the operational liquidity and needs of its business and that its stock is selling at a material discount to the company's intrinsic business value, conservatively calculated.

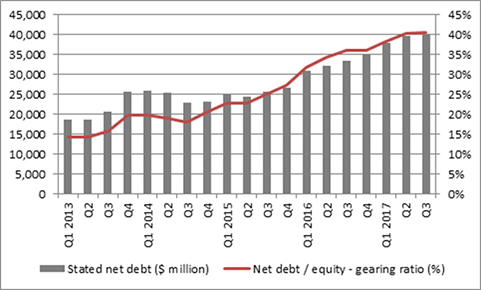

“BP’s shares have rallied hard, so they are not as cheap as they were, whilst the hard-earned improvement in cash flow is only nascent. In addition, net debt has continued to rise, so it is possible that some shareholders would have preferred the company to pay off some of its liabilities when times are good, especially as a big debt pile could crimp BP’s ability to increase (or even hold) dividend payments in the event of a fresh slump in oil prices.”

Source: Company accounts

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17