Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Health-to-hygiene group Reckitt Benckiser is bowing to the inevitable by downgrading its organic sales growth target for the year, although shareholders appear (surprisingly) unperturbed, as they focus instead on a corporate reorganisation designed to fully integrate the summer’s Mead Johnson acquisition and strip more costs out of the business,” says AJ Bell Investment Director Russ Mould.

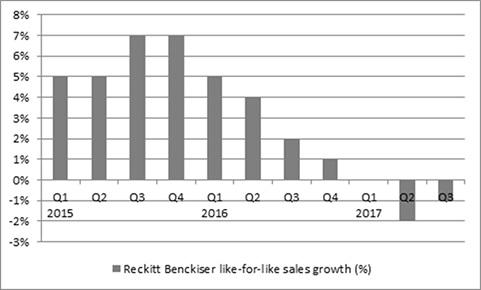

“Reckitt had already cut its sales growth target from 3% to 2% and after a 1% year-on-year slide in the third quarter boss Rakesh Kapoor has abandoned even the lower number, saying that underlying revenues are now expected to come in flat.

Source: Company accounts

“Investors do not seem too concerned for three reasons:

- The stock has already fallen by some 12% since the July downgrade

- The third quarter showed some improvement on the second, as sales fell 1% compared to 2%, helped by a slower rate of decline at Healthcare (Gaviscon and Durex) and a return to growth at Hygiene (Finish, Harpic and Lysol).

- CEO Rakesh Kapoor has unveiled the second major corporate reorganisation of his tenure, by creating two new business units, RB Health and RB Hygiene. Health will include Mead Johnson, acquired in the summer for nearly $18 billion and the plan seems to be to strip overlapping costs between the purchase and Reckitt’s existing management structure.

“However, not everyone will be convinced by today’s figures.

- Reaching flat underlying sales for the year could still be a challenge even if the base for comparison is much easier as sales will have to grow in the fourth quarter following three periods that have come in flat to down.

- The corporate reorganisation will be seen by sceptics as a means of changing how Reckitt presents its figures at divisional level and thus muddying the waters when it comes to measuring underlying performance.

- The stock is still trading on a huge premium to the UK market on just over 21 times forward earnings for 2017 and 19 times for 2018 (according to analysts’ consensus forecasts) compared to 15 times and 14 times for the FTSE 100. Reckitt’s brand strength, lofty margins and record of consistent profit and dividend growth can justify the premium rating but the lack of organic growth, admission of pricing pressure in areas such as Home (Vanish) and Laundry and the growing reliance on both acquisitions and cost cutting all raise the issue of whether the stock deserves such a lofty valuation.

“Using acquisitions to fuel growth raises the risks involved (owing to the debt associated with the Mead deal and the danger something goes wrong during integration) and lowers the quality of earnings (given the reliance on cost-cutting rather than top-line growth).”

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17