Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"Shares in Imagination Technologies are down by two-thirds this morning after key client Apple’s decision not to use the FTSE Small Cap’s silicon chip designs in products due for release in 18 to 24 months’ time," says AJ Bell Investment Director Russ Mould.

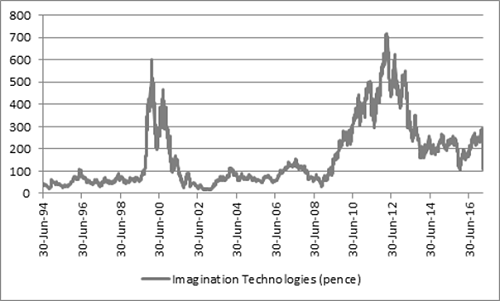

“This is a juddering setback for Imagination, whose shares had begun to run strongly under chief executive Andrew Heath. Today’s plunge takes Imagination back to levels last seen in 2009 and leaves the shares way adrift of 2012’s peak north of 700p (a mark they had even failed to reach during the technology, media and telecoms bubble of 1998-2000).

“Imagination’s share price history, one marked by huge gains and then equally dramatic falls dating all the way back to its 1994 flotation as VideoLogic plc, is an object lesson to investors on the pleasure and pain that investors can enjoy and suffer when investing in technology stocks for five reasons (1999’s name change may have been the result of prior profit setbacks which led to the firm unwittingly acquiring the nickname of ‘VideoNasty’):

Source: Thomson

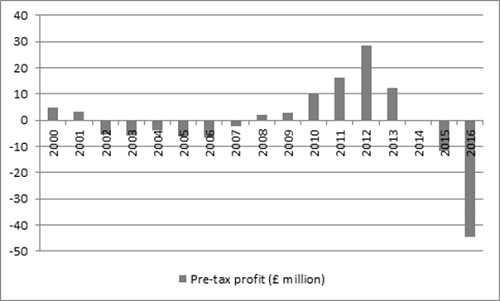

1. “Having great technology is ultimately never enough – share prices are driven by profits and cash flows in the end. Imagination’s record here has tended to be spotty at best, even if December’s interims showed some promising underlying progress, helped by the restructuring programme.

Source: Company accounts. Financial years to March/April.

2. “Over-reliance on one major customer is always a red flag. Apple represents more than half of Imagination’s revenues, so losing this business is a huge blow. ARM, before its 2016 acquisition by Softbank, always commanded – and deserved – a higher valuation as its revenue streams and customer base was so much more diverse.

3. “Buying a stock for a potential takeover bid is a mug’s game. Either the bid fails to appear or it takes longer than expected (and comes at a price lower than hoped). There had been speculation that Apple would think about acquiring Imagination and take control of its PowerVR graphics chips so it could deprive rival products of them. Apple is now developing its own chips so there is no need to license them from Imagination, let alone buy the firm.

4. “There are few worse investments than a perceived growth stock that fails to deliver the growth.

5. “Obsolescence risk remains a key challenge for any tech firm, no matter how cutting-edge its products seem to be today. The only way to guard against this is to pay a lowly valuation – but by their very nature go-go tech names tend to trade on high ratings as investors clamour for and price in their long-term growth potential. Value hunters tend to avoid tech for this reason, as the list of tech stock corpses is a long one in what is a well-stocked graveyard, both in the UK and globally.

“The smart phone and tablet computer are just the latest developments in a never-ending cycle of technological evolution. Each turn of the wheel has brought feast for a select few winners, who 'got it' and had first-mover advantage – and also famine for those whose offerings were overtaken and left looking old hat…

- “In the 1960s, IBM dominated mainframe computing.

- “In the 1970s, Big Blue’s predominance came under attack in the 1970s from the BUNCH companies – Burroughs, UNIVAC, NCR, Control Data and Honeywell.

- “In the 1980s that quintet fell by the wayside when the minicomputer took over, as DEC, Wang Labs, Prime Computer and Data General became the new tech industry darlings.

- “The early 1990s saw the advent of the early personal computers (PCs), a market bossed to great effect by Apple, Tandy and Commodore.

- “The late 1990s brought another shift, as the Wintel (Microsoft Windows-Intel microprocessor)-fired desktop and laptop personal computers took over, propelling Compaq, Gateway, NEC/Packard Bell and Dell into the spotlight, although the mobile phone began to creep up on the rails, a trend which temporarily left Finland’s Nokia as king of the technology hill.

- “The 2000s brought nemesis to Nokia which fell off its perch with frightening speed as smartphones and then netbooks took over, to the benefit of a completely reinvented Apple and Korea’s Samsung grabbed the lead.

- “After 2010 the tablet computer became the latest consumer darling although its time at the top looks destined to be a short one, as sales are already sliding at Apple and the price is simply too high to facilitate the mass adoption enjoyed by mobile phones. In the business area, demand for servers and enterprise infrastructure has boomed as corporations have sought to optimise storage, use the cloud and manage a deluge of data more efficiently, helping Intel, IBM and Dell, amongst others, in their efforts to reinvigorate their growth profiles. Social media and the internet also continue to change how information is disseminated, digested and used by consumers – a trend which Facebook, Alphabet and Netflix are driving hard.

“A few firms enjoy their day in the sunshine and they make plenty of hay (or profit and cash flow) – but the problem is very few stay at the top for more than five or ten years and once they fall, they fall hard (and in many cases, as suggested by the list above, pretty much disappear altogether).”

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17