Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“In these income-starved times of record-low interest rates and depressed bond yields it is hard to believe that a FTSE 100 stock barely moves when the management team affirms dividend plans that equate to a 7.7% yield for 2017,” says AJ Bell Investment Director Russ Mould.

“But shares in Taylor Wimpey are shrugging at exactly such an announcement this morning, in the same manner as those of Persimmon did yesterday, as investors look for volume growth to provide insurance against cost increases, boost dividend cover and reassure that the housing market remains in good health.

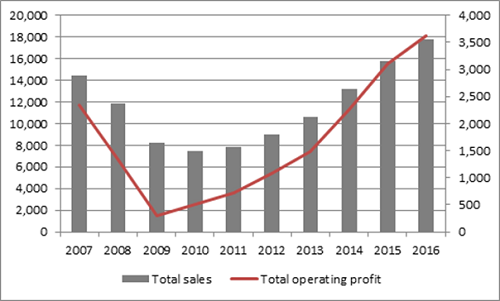

“The good news is that the big seven house builders who have been listed for the last decade generated 23% more sales and 55% more profit in 2016 than they did at the pre financial crisis peak in 2007.

Source: Company accounts. Covers Barratt, Berkeley, Bovis, Persimmon, Redrow and Taylor Wimpey

“Forward visibility is good, as combined order backlogs (or forward sales figures) come to £12 billion against £5.3 billion a decade ago, while their balance sheets are in terrific shape, with an total of £1.9 billion in net cash between them, compared to £3.7 billion in net debt (a sum that was largely the result of the Barratt-Bowden and Persimmon-Westbury acquisitions).

“This cash position means Persimmon, Berkeley, Barratt and Taylor Wimpey are all running generous capital return plans for shareholders, via ordinary dividends, special dividends or (in the case of Berkeley) possible share buybacks.

“Yet the stocks are struggling to make much progress despite such largesse, having recouped much if not all of the ground lost in the wake of the Brexit vote last June and growth may be the reason why.

“Despite the bumper sales and profits, the house builders completed just 2% more houses in 2016 than they did in 2007 – the revenue and earnings upside has largely come from price increases.

Source: Company accounts. Covers Barratt, Berkeley, Bovis, Persimmon, Redrow and Taylor Wimpey

“Record-low interest rates and Government initiatives such as Help to Buy (and now the Lifetime ISA) may help to keep the pot boiling, but they are stoking demand, not supply and there has to be a risk that average house prices eventually reach a level whereby buyers will struggle to afford them, no matter what external help they get (barring perhaps the bank of Mum and Dad).

“This may explain why house builders continue to rail against a complex and slow planning permission process and analysts are only pencilling in limited sales and profit growth for 2017, especially as most of the builders expect cost increases to run in the low single-digits this year, potentially limiting operating margin and profit upside.

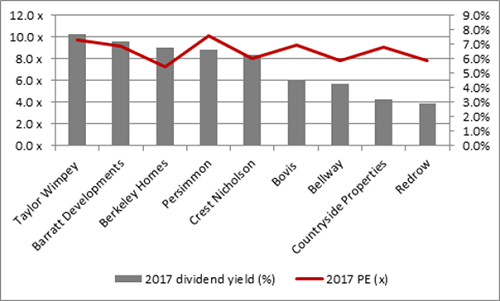

“It is this scepticism about growth and fears whether Brexit or high prices or record-levels of consumer debt that could crimp housing demand that leave the big house builders on generous yields and low earnings multiples – as the lowly valuation is the market’s way of saying it doesn’t entirely trust the earnings forecasts.

Source: Digital Look, consensus analysts’ forecasts

"The net cash balance sheets provide ample support to the dividend forecasts and in theory the builders could meet their lavish cash return plans in the event of an unexpected downturn by stopping buying land.

"But it is buying land cheaply during downturns that provides margin and profit upturns during the subsequent recoveries (something Tony Pidgeley at Berkeley has demonstrated with particular skill time and again) so this decision may not prove as straightforward as it seems if and when the time comes to make it."

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17