Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Investors should be wary of the hype and focus on the basics of cash flow when they decide whether social media company Snap is worth the $20-25 billion price tag slapped on the firm by management,” says Russ Mould, investment director at AJ Bell.

“It is understandable that the company, which is the parent of messaging service Snapchat, will attract a lot of attention and potentially a lofty valuation.

- “First, its S-1 regulatory filing document shows that Snap has 158 million daily active users and is growing rapidly. Sales surged to $404m in 2016 from $59m in 2015 and investors are still hungry for stocks which offer the prospect of secular growth.

- “Second, Snap’s documentation makes it clear the firm has more to offer than just the instant messaging service which made its name. Snap is positioning itself as a camera company and one that offers experiences that are much richer than a 10-second conversation.

- “Third, it’s established internet and social media peers like Facebook, Alphabet, Alibaba and Tencent have done very well in the last 12 months.

“However, this does not necessarily mean investors should fall over themselves and pay any price for the US-listed stock, also for three reasons.

- “First, Snap is selling shares which will have no votes, so shareholders will have no voice or say in how the company is run. This may seem a good idea but it could leave investors high and dry if and when anything goes wrong and not all gifted entrepreneurs make great business executives or managers.

- “Second, Snap is losing money by the bucketful. Net losses surged to $514 million in 2016, from $373 million the year before, despite the huge surge in users and revenues. Ultimately, it is profits and cash flow that support and drive a company’s valuation, not just the number of customers it has. The company clearly has plans to develop new services – and potentially acquire other firms – but investors will be taking a lot on faith to price this into the valuation before they can see what these strategic initiatives might be. Snap’s main source of income at the moment is selling advertisements targeted at its core youthful demographic, although the younger generation isn’t the one that has all of the money, so it remains to be seen whether advertisers feel they get value for the exposure Snap can offer.

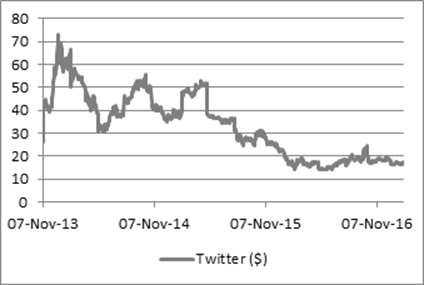

- “Third, Facebook, Alphabet, Alibaba and Tencent have all done well but they all have bigger user bases and more diversified revenue models. For the moment, Snap more closely resembles Twitter, which also floated on the back of rapid user growth and plans to increase revenues by increasing customer engagement. Twitter initially saw its shares do well but they have subsequently collapsed as a series of new service offerings have failed to drive any profits or positive cashflow. At yesterday’s closing price of $17.78 Twitter now trades below its $26 flotation price.

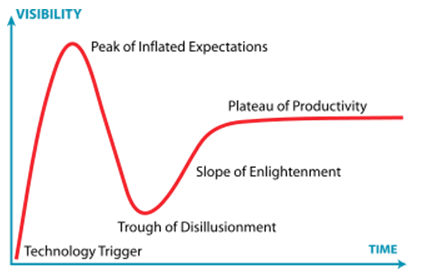

“Intriguingly, the trajectory of Twitter’s share price since its 2013 stock market listing looks remarkably similar to the first three stages of the five outlined in the “hype cycle” presented by consultants Gartner to show how technologies (and technology companies) often develop, whereby initial excitement fuels over-inflated expectations and then disappointment before maturity, widespread acceptance and ultimately profitability.

Source: Thomson Reuters Datastream

Source: Gartner

“Investors who do wish to look closely at Snap must therefore be aware of the risks they are taking, as well as the potential upside, focussing on the firm’s plans to generate profits and cash rather than the hype, especially as the lack of voting rights and huge valuation leave them with little downside protection if anything does go awry.”

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17