Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The FBI’s decision not to investigate Hillary Clinton is reviving claims from Donald Trump that the election is fixed and raises the prospect of him contesting the result, something he hinted at in the TV debates. If the US election does go to the courts, dollars, real ‘stuff’ and bonds may be worthy bolt-holes for investors based on past experience.

The prospect of a contested election rekindles uncomfortable memories of the 2000 Presidential Election, which was followed by strong performance from commodities, the US dollar and bonds as the ballot was only decided by the Supreme Court after a month’s intense debate over the decisive vote in Florida.

The 2000 US election took place on 7 November but George W. Bush was only officially declared the winner after a 5-4 decision by the US Supreme Court on 12 December of that year. The month in between saw a recount in Florida and then further recounts in some counties, prompted by litigation, as the unsuccessful Democrat candidate Al Gore raised the issue of “hanging chads” and whether voters’ ballot papers had been counted correctly.

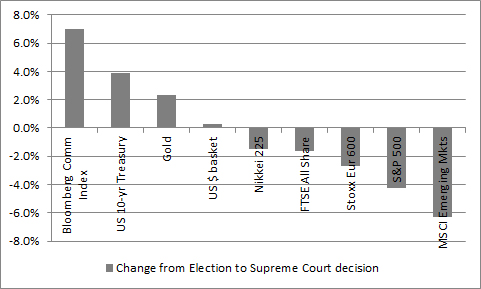

During that five-week period of uncertainty, stocks slumped in the USA and worldwide. Investors sought refuge in commodities (notably gold), the dollar and US Treasury bonds:

Source: Thomson Reuters Datastream

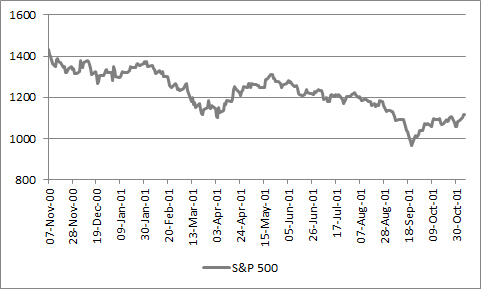

The US Supreme Court confirmed George W. Bush had won Florida and therefore the race to the Presidency and he was duly sworn in during January 2001. However, any investors who were tempted into buying on the dips in the stock market got caught out.

A rally in the America’s benchmark S&P 500 index proved short-lived and a trap for dip-buyers:

Source: Thomson Reuters Datastream

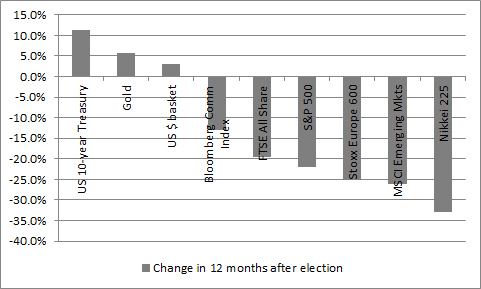

This was because the tech, media and telecoms bubble had begun to burst and 2001 was a tough year for stocks, even if the worst of the rout took place in 2002. In the 12 months after that contested and controversial US election of 2000, US Treasuries, gold and the dollar generated positive returns while stocks took a battering.

Source: Thomson Reuters Datastream

If the 2016 election is contested – and this is by no means certain – investors must be wary of the reflex temptation to buy on any dip and do their research to ensure the underlying fundamentals of the US equity market remain sound, even if the example offered by the UK’s Referendum vote in June is a potentially encouraging one.

Russ Mould, Investment Director at AJ Bell

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17