Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

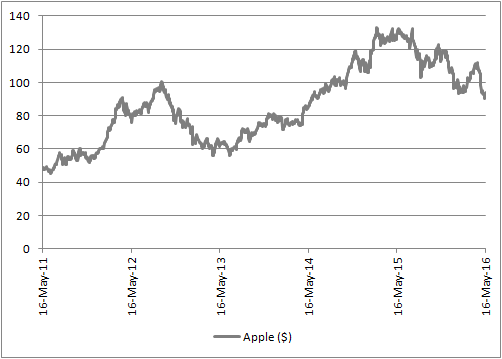

A difficult year for the technology giant Apple is taking an interesting turn with the news that legendary “value” investor Warren Buffett has bought a stake worth just over $920 million, at the prevailing price of $93.88.

Apple’s shares have received a welcome boost after the Buffett swoop

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Apple’s second-quarter results, to the end of March, featured the first year-on-year drop in earnings since 2013, the first drop in group sales for more than a decade and the first ever decline in iPhone sales.

There are few worse investments than a growth stock that goes ex-growth and Apple’s 30%-plus fall from last year’s peak reflect that. Equally, Buffett’s preference for companies with good brands, market-leading positions, robust cash flow and strong balance sheets that trade on sensible valuations helps to explain why the Sage of Omaha has piled in.

Not all investors will have time to study one stock in any depth, even if it is one of the world’s top five by market cap, but many of them may be interested in technology stocks.

In a low-growth world any firm capable of generating rapid organic profit increases will be highly prized and technology is one logical area to look.

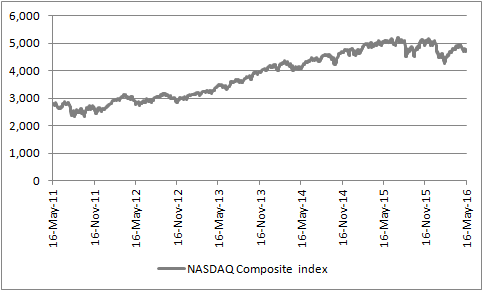

But Apple’s 2016 stumbles and Buffett’s purchase raise interesting questions about how investors can assess technology or growth-focussed funds, if they feel they are an appropriate asset class to consider within the realms of a balanced portfolio. America’s leading tech-heavy index, the NASDAQ Composite, is making heavy weather of getting back to last year’s all-time highs as the profit warnings start to come thick and fast from tech firms of all shapes and sizes.

The tech-heavy NASDAQ Composite index has lost a little momentum of late

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Wheel of fortune

The smart phone and tablet computer are just the latest developments in a never-ending cycle of technological evolution. Each turn of the wheel has brought feast for a select few winners, who 'got it' and had first-mover advantage – and also famine for those whose offerings were overtaken and left looking old hat.

- In the 1960s, IBM dominated mainframe computing.

- In the 1970s, Big Blue’s predominance came under attack in the 1970s from the BUNCH companies – Burroughs, UNIVAC, NCR, Control Data and Honeywell.

- In the 1980s that quintet fell by the wayside when the minicomputer took over, as DEC, Wang Labs, Prime Computer and Data General became the new tech industry darlings.

- The early 1990s saw the advent of the early personal computers (PCs), a market bossed to great effect by Apple, Tandy and Commodore.

- The late 1990s brought another shift, as the Wintel (Microsoft Windows-Intel microprocessor)-fired desktop and laptop personal computers took over, propelling Compaq, Gateway, NEC/Packard Bell and Dell into the spotlight, although the mobile phone began to creep up on the rails, a trend which temporarily left Finland’s Nokia as king of the technology hill.

- The 2000s brought nemesis to Nokia which fell off its perch with frightening speed as smartphones and then netbooks took over, to the benefit of a completely reinvented Apple and Korea’s Samsung grabbed the lead.

- After 2010 the tablet computer became the latest consumer darling although its time at the top looks destined to be a short one, as sales are already sliding at Apple and the price is simply too high to facilitate the mass adoption enjoyed by mobile phones. In the business area, demand for servers and enterprise infrastructure has boomed as corporations have sought to optimise storage, use the cloud and manage a deluge of data more efficiently, helping Intel, IBM and Dell, amongst others, in their efforts to reinvigorate their growth profiles. Social media and the internet also continue to change how information is disseminated, digested and used by consumers – a trend which Facebook, Alphabet and Netflix are driving hard.

A few firms enjoy their day in the sunshine and they make plenty of hay (or profit and cash flow) – but the problem is very few stay at the top for more than five or ten years and once they fall, they fall hard (and in many cases, as suggested by the list above, pretty much disappear altogether).

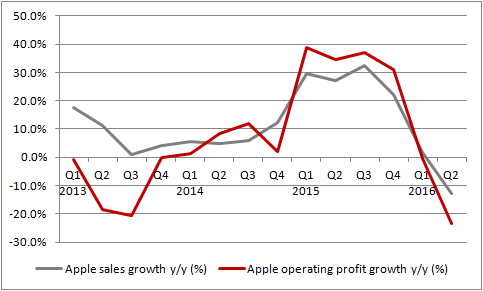

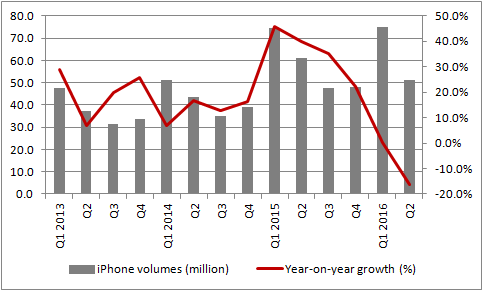

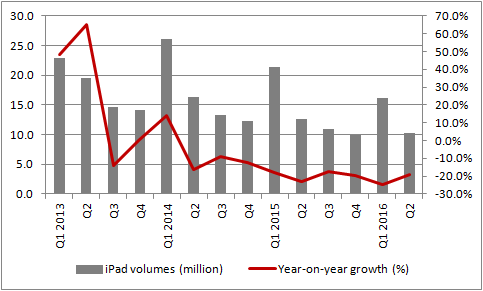

The first chart below shows Apple’s sales and operating profit growth year-on-year, the second shows volumes and growth rates for iPhones, and the third the same for its iPads – note the iPad volumes at Christmas 2013.

Apple needs to rebuild sales and profit growth momentum ....

Source: Company accounts. Refers to company's financial year - Q1 is calendar Q4

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

... as iPhone sales slow ahead of new product launches ....

Source: Company accounts. Refers to company's financial year - Q1 is calendar Q4

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

... and iPad volumes languish way below 2013 highs

Source: Company accounts. Refers to company's financial year - Q1 is calendar Q4

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Ripple effect

Again, the comings and goings at one stock will be of modest interest to some investors, especially as it is an overseas-listed stock. But Apple’s size means it has huge impact on the technology foodchain, as silicon chip makers, precision instrument experts, circuit board manufacturers and others all benefit when the Californian giant do well – and catch a cold when its fortunes are not so good.

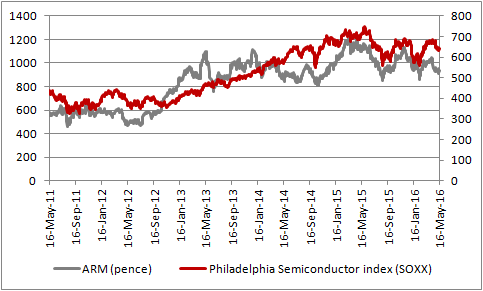

A number of US and Asian silicon chip companies, such as Qorvo, Cirrus Logic, Skyworks, Broadcom, NXP, Texas Instruments, TSMC and others have issued disappointing earnings or profits guidance as Apple has hit its growth bump. This has weighed on this column’s old friend, the Philadelphia Semiconductor Index, or SOXX, of which the UK’s ARM is also a member.ARM is a member of the Philadelphia Semiconductor Index

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

All of these firms will be hoping the launches of the iPhone7 in September of this year and iPhone 8 in September of next bring some good news, although Apple’s problem seems to be a lack of killer new innovations and upgrades – at least relative to the quantum leap on functionality offered by the earliest iPhones, especially as the Watch is barely mentioned any more.

Wider growth gap

But the Apple foodchain is not the only one going a little hungry.

A number of big-cap names were hammered after they delivered disappointing earnings reports for the first quarter or weaker-than-expected earnings guidance for the second.

Alphabet (Google as was), IBM, Intel, Microsoft and Oracle all came in with figures or outlook statements which missed forecasts and in many cases their share prices took a drubbing. Only Amazon and Facebook really offered tech bulls any succour by beating forecasts, as key tech markets like smartphones, computing, telecom equipment and even automotive began to show some signs of slowing down.

Technology is therefore cyclical – but the cycle is one tied to innovation, new releases and product advantage rather than the broader economy.

The need to follow multiple product cycles makes technology investing a difficult area for time-poor investors, despite the potential for capital appreciation from winning tech stocks. This is where specialist help from an experienced fund manager can add value to those who have a sufficient appetite for risk and a desire to seek out capital appreciation.

According to Morningstar, there are ten exchange-traded funds which track baskets of technology stocks on a global basis and another three which follow the tech-laden NASDAQ 100 benchmark. The five best performers among those dedicated to technology with a five-year lifespan are listed below (even if some of them are not very big).

Best performing technology-dedicated investment trusts over the last five years

| Investment company | EPIC | Market cap (£ million) | Annualised 5-year performance* | Dividend yield | Ongoing charges ** | Discount to NAV | Gearing | Morningstar rating |

| Allianz Technology | ATT | 152.0 | 11.2% | n/a | 1.11% | -8.8% | 0% | ***** |

| Polar Capital Technology | PCT | 754.0 | 8.9% | n/a | 1.08% | -7.8% | 0% | **** |

* Share price. ** Includes performance fee

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

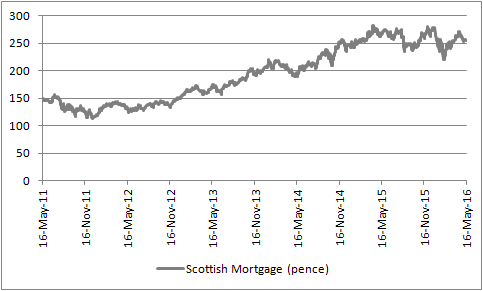

A further name to research here is Baillie Gifford’s Scottish Mortgage, which focusses on global growth stocks in its quest to provide above-average returns over a five-year rolling period. Interestingly, Apple is not a top-ten holding, whereas internet plays Amazon.com, Baidu, Tencent, Facebook, Alibaba and Alphabet are, alongside electric car pioneer Tesla.

Scottish Mortgage has a strong growth-stock bias

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

There is further choice on offer from a wide number of specialist open-ended funds.

Best performing technology-dedicated OEICs over the last five years

| OEIC | ISIN | Fund size £ million | Annualised 5-year performance | 12-month yield | Ongoing charge | Morningstar rating |

| Fidelity Global Technology W (Acc) GBP | LU1033663649 | £650.5 | 12.6% | n/a | 1.17% | ***** |

| Close FTSE TechMark X (Acc) | GB00B87JKQ15 | £40.1 | 11.7% | 1.65% | 0.69% | ***** |

| Legal & General Global Technology Index I (Acc) | GB00B0CNH163 | £79.4 | 11.7% | 1.30% | 0.32% | ***** |

| Pictet Digital Communication I (DY) GBP | LU0448836279 | £467.2 | 11.5% | n/a | 1.20% | **** |

| Henderson Global Technology I (Acc) | GB0007716078 | £486.6 | 10.4% | 0.22% | 0.85% | ***** |

Where more than one class of fund features only the best performer is listed.

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

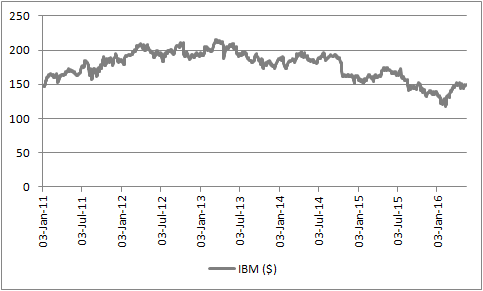

As a final point, investors could simply back Buffett’s judgement and buy into Berkshire Hathaway stock, although the $212,530 per share price tag may deter more than a few. Two of his top 20 holdings are now tech companies – IBM and Apple.

His first pick, IBM, has yet to cover itself in glory since his initial purchase in the first quarter of 2011 in capital terms, although the company has paid out dividends worth more than $20 a share and run a handsome share buyback programme in the meantime.

IBM has yet to prove itself to be a good pick for Buffett

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Russ Mould

AJ Bell Investment Director

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 02/05/2025 - 11:37

- Thu, 01/05/2025 - 16:33

- Thu, 01/05/2025 - 09:45

- Tue, 29/04/2025 - 11:41

- Fri, 25/04/2025 - 14:52