Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

It is interesting to see Prime Minister David Cameron equate voting to leave the EU on 23 June with “a step in the dark”, as he gives the UK electorate the ultimate say on 43 years of membership of the economic bloc.

That phrase is very close to the “leap in the dark” used by the now-defunct Punch magazine with regard to the 1867 (Second) Reform Act. Benjamin Disraeli’s minority Conservative Government surprised a lot of people by launching the legislation and then successfully squeezing it through Parliament. Disraeli and the Tories then got an even bigger shock when the newly-enfranchised voters showed their gratitude by voting for Gladstone and the Liberals in the 1868 General Election, so this might not be the most encouraging historic precedent for the current Prime Minister.

It also goes to show that it is hard to predict the outcome and implications of the June vote, although investors will need to consider all of their options, and perhaps consider a worst-case scenario which – no matter how unlikely – would probably be a severe slump in sterling and pressure on the Bank of England to jack up interest rates.

Status quo

The first possible outcome, however, is the UK population votes to stay in the EU and preserve the status quo. In this event it is possible that

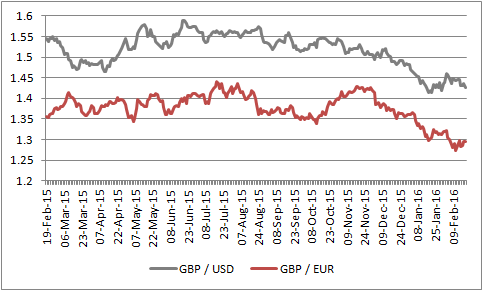

- The currency. The pound rallies to regain some of the ground it has lost against both the euro and the dollar in recent weeks, as per this chart here:

The pound has lost ground amid Brexit fears

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

- The bond market. Gilts see prices rally and yields go lower again, as uncertainty is removed and UK government bonds retain their haven status, especially as there is less danger for overseas holders of the paper, if the pound rallies.

10-year UK Gilt yields stand near historic lows

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

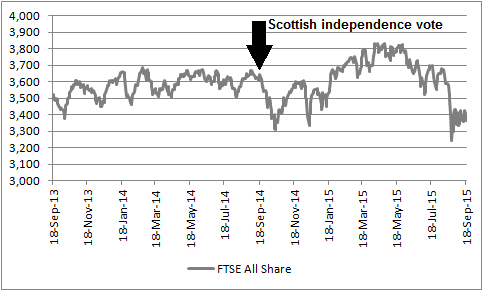

- The stock market. UK equities may be relatively unmoved, although there could be a relief rally as uncertainty is removed. After all, Prime Minister Cameron would find it hard to survive a defeat in the vote, prompting a Tory leadership contest. The Scottish National Party would also argue an exit represented a material change and grounds for a second referendum ballot on independence. Both ballots would create additional uncertainty.

That said there are no guarantees. The UK market went down after the Scottish vote before launching a six-month rally that proved pretty short-lived.

Relief rallies in UK stocks post the Scottish referendum did not last long

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

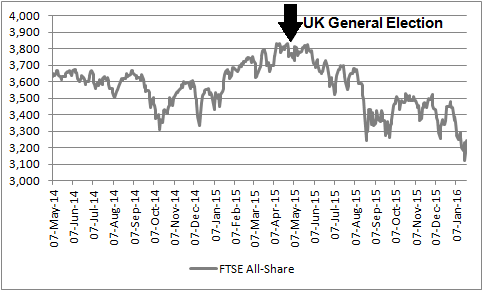

The FTSE All-Share then peaked very shortly after a post-election jump last spring.

.... and the post-General Election rally lasted barely a week

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

The big issues

So the implications of a “stay” vote are far from clear cut, from a stock market perspective, and the same can be said for a “leave” vote. It’s unlikely the markets would welcome the political uncertainty of an exit if it did lead to the Prime Minister falling from office or trigger a second Scottish independence vote but the ultimate result would depend on the winners in each of those contests.

More tangibly we can look at the economic implications, which some excellent research from David Page of AXA Investment Management argues touch upon five areas:

- Trade with the EU and whether new, free-trade agreements can be struck with EU members or indeed other regions and nations and whether overseas companies will withdraw from, or stop investing in, the UK

- Migration and workforce growth

- Regulation

- Budgetary payments to the EU, which come to £9 billion, or 0.5% of GDP

- The impact on the City and the UK’s financial services industry (8% of UK GDP)

In the opinion of the analysts at Capital Economics the potential positives and negatives of a “leave” vote and withdrawal from the EU can be summarised as follows:

Sources of possible gains and losses from Brexit

| Benefits of leaving EU | Losses from leaving EU |

| Less regulation | Possible tariffs on exports to European Union |

| Savings on budget contributions | Loss of access to the single market |

| Ability to strike new trade deals | Damage to the City |

| Skills-based migration policy | Drop in investment caused by uncertainty |

Source: Capital Economics

Proponents of a “stay” vote argue the cost could be between 2% and 9% of UK GDP (albeit over a 10-year span or more) while “leave” backers like UKIP argue the benefit would be more than 5% owing to lower budgetary payments, less regulation and better allocation of capital.

A vote for change

If voters decide to vote for Brexit and Mr Cameron’s “step in the dark” it seems possible that:

- The currency. Sterling could slide given the uncertainty caused by the lengthy exit process and subsequent prolonged trade negotiations with individual EU members and other global nations. Note that the pound lost more than 1% against the dollar in early trading on Monday.

- The bond market. Gilts may wobble as the 10-year yield of 1.41% is pretty skinny and could be easily wiped out by falls in the pound, if you’re an overseas holder (and a third of the Gilt market is owned by foreigners). This is important – the UK runs a budget, trade and current account deficit so we bring in less than we earn. This means we are dependent on funding from other countries – and if they take fright and stop buying or holding sterling assets that would be awkward. In an extreme scenario it could even hit the pound so hard the Bank of England has to put up interest rates to defend sterling.

Sterling has suffered similar such crises of confidence, so a repeat cannot be entirely ruled out because of that triple deficit, very unlikely as it seems right now. Prime Minister Harold Wilson devalued the pound from $2.80 to $2.40 in 1967, while sterling took a battering as then Chancellor of the Exchequer Denis Healey had to turn to the International Monetary Fund for an emergency loan in 1976 and the currency was forced out of the Exchange Rate Mechanism in 1992 when in the care of the Conservative administration of John Major and Norman Lamont.

The performance of the FTSE All-Share before and after those crises offers some guidance as to what may happen this time. In the run-up to 1967 the market did well but then ran out of steam afterwards as interest rates rose to combat inflation. In the cases of 1976 and 1992, the economy had been struggling but then picked up speed helped by falls in the pound and a lowering of interest rates.

FTSE All-Share performance during post-war sterling crises

| Performance of FTSE All-Share Index BEFORE |

Performance of FTSE All-Share Index AFTER |

||||||||||

| Date | Event | 36 months | 24 months | 12 months | 6 months | 3 months | 3 months | 6 months | 12 months | 24 months | 36 months |

| 19-Nov-67 | Sterling devalued | 22.4% | 19.9% | 39.0% | 20.6% | 18.1% | 1.8% | 15.6% | 31.7% | 13.4% | 4.7% |

| 28-Sep-76 | UK calls in IMF | -22.8% | 84.7% | -5.2% | -16.2% | -8.8% | 4.9% | 23.2% | 59.2% | 63.2% | 81.3% |

| 16-Sep-92 | Sterling devalued | -7.1% | 9.6% | -11.6% | -6.2% | -11.7% | 16.8% | 27.7% | 33.9% | 38.0% | 57.4% |

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

- The stock market. The picture is more nuanced this time. The economy is just about hanging in there but it looks fragile, weighed down as it is by debt, while interest rates can hardly go any lower. Although it’s hard to see a repeat of the sterling crises of 1967, 1976 and 1992, not least because there is no fixed exchange rate to defend, it is worth bearing the worst-case scenario in mind, although Governor Mark Carney may be pleased to see the pound fall – it could boost inflation and exports, after all.

Back to 1992

To prepare for the (still seemingly distant) prospect of a sharp fall in the pound it may be worth stepping back to 1992, as a slide in sterling could create stock and sector winners and losers, depending on where they sell and where their costs and assets are.

In the 12 months before 1992’s “Black Wednesday” the UK economy was mired in recession and defensive sectors held sway.

Best and worst performing equity sectors before sterling’s 1992 devaluation

| Top and Bottom 10 performing sectors before 16 September 1992 and devaluation of sterling | |

| 12 months before ERM exit | |

| Pharma & Biotech | 14.1% |

| Electricity | 9.4% |

| Beverages | 0.1% |

| Electricals/Electronics | -0.5% |

| Mining | -2.0% |

| Healthcare Equipment/Services | -3.2% |

| Software & Services | -4.9% |

| Support Services | -4.9% |

| Media | -6.2% |

| Industrial Transportation | -6.4% |

| FTSE All-Share | -11.6% |

| Personal Goods | -15.3% |

| Equity Investments | -15.8% |

| Autos & Parts | -22.4% |

| Oil & Gas Producers | -23.1% |

| Aerospace & Defence | -24.8% |

| Non-life insurance | -35.5% |

| Industrial Metals | -43.4% |

| Forestry & Paper | -45.5% |

| Construction & Materials | -47.3% |

| Tech Hardware | -50.9% |

Source: Thomson Reuters Datastream

Once sterling had done its swan dive out of the ERM, cyclical stocks and export-driven sectors quickly took charge. Forestry, Aerospace and Tech Hardware were among the best performers in the 12 months after the pound’s plunge, while defensive sectors like Beverages, Pharmaceuticals and Food Retailers lagged (even if their performance in absolute terms was far from disastrous).

Best and worst performing equity sectors after sterling’s 1992 devaluation

| Top and Bottom 10 performing sectors after 16 September 1992 and devaluation of sterling | |

| 12 months after ERM exit | |

| Financial Services | 99.3% |

| Construction & Materials | 88.8% |

| Industrial Metals | 70.1% |

| Banks | 69.4% |

| Tech Hardware | 64.6% |

| Forestry & Paper | 56.7% |

| Equity Investments | 56.3% |

| Aerospace & Defence | 56.1% |

| Non-life insurance | 56.0% |

| Electricals/Electronics | 51.7% |

| FTSE All-Share | 33.9% |

| Leisure Goods | 34.2% |

| Fixed Line Telecoms | 32.6% |

| Chemicals | 24.0% |

| Food Producers | 23.2% |

| Mining | 21.1% |

| Healthcare Equipment/Services | 17.6% |

| Food & Drug Retailers | 13.4% |

| Personal Goods | 8.2% |

| Beverages | -3.0% |

| Pharma & Biotech | -17.4% |

Source: Thomson Reuters Datastream

Last word

If you are convinced that the result will be a vote for Brexit and that the result will be a weaker pound - and these are decisions that only you can take - then another option would be to look at buying overseas assets, either directly or through a fund, as their value will rise when translated back into pounds. However, any such trades bring in other risks, including that their price could fall more than the pound, leaving you worse off than when you started.

Given the uncertainty investors may decide to do nothing and leave portfolios unchanged, since none of us has a crystal ball and there are so many variables. At least this would avoid incurring any unnecessary trading costs as 23 June draws nearer.

Russ Mould

AJ Bell Investment Director

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 02/05/2025 - 11:37

- Thu, 01/05/2025 - 16:33

- Thu, 01/05/2025 - 09:45

- Tue, 29/04/2025 - 11:41

- Fri, 25/04/2025 - 14:52