Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

While the result of the Greek referendum (5 July) looks dramatic, particularly given the huge margin of victory recorded by those who campaigned against acceptance of the latest European Union bail-out and reforms proposal, in reality it changes little.

For his part, Greek Prime Minister Alexis Tsipras is arguing this strengthens his hand when it comes to renegotiating a deal, even if the departure of Finance Minister Yanis Varoufakis means Athens may now have a more emollient representative at any future talks. On the other side, Berlin and Brussels seem unconvinced, saying there will be no more talks until Athens offers more concrete plans for fiscal reform. This may be a matter of politics as it is economics or philosophy, as neither Chancellor Merkel nor President Juncker will want to offer any concessions and thus succour to anti-EU parties elsewhere, especially Spain and Portugal ahead of their elections later this year.

The vote does increase the chances of Greece leaving – or being ejected from – the Eurozone and the euro, given the parlous state of Greece’s banks and its economy. This means investors face a range of possible scenarios from an investment perspective, even if this may not be everyone’s immediate priority, given the hardship facing Greek citizens right now.

- Brussels and Athens strike a deal fairly quickly

- The European Central Bank steps in and tries to maintain calm by accelerating or increasing the scope of its Quantitative Easing (QE) scheme

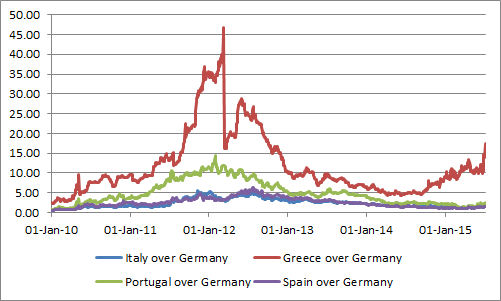

- Talks fail and chaos breaks out as markets fear a re-run of 2010 and 2012 when Greece’s woes had a big – and negative – impact on European economic and broader market confidence. Investors might even start to worry about Italy, Portugal and Spain again, especially if Greece does exit. A tell-tale sign here would be a widening of credit spreads relative to Germany – the difference in yield between the nations’ respective 10-year Government bonds. For the moment, the market response looks relatively muted and nothing like what we say three and five years ago, with the exception of Greece itself.

Italian, Spanish and Portuguese yield differentials versus Germany remain relatively muted ....

Source: Thomson Reuters Datastream. Shows the spread between 10 year sovereign bonds, measured in basis points.

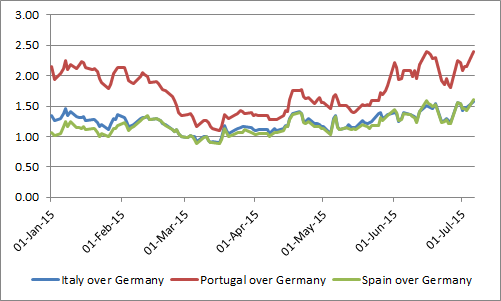

... even after mild increases in the past month

Source: Thomson Reuters Datastream Shows the spread between 10 year sovereign bonds, measured in basis points.

As last week’s column noted, Eurozone equities are among the cheapest in the world, on a cyclically-adjusted price/earnings (CAPE) basis. Some investors would argue Europe is cheap for a good reason but those who believe any fresh convulsions will create a stronger Eurozone, by pushing out the weakest link and reinforcing the others, may view any equity market retreat as an opportunity. In this case there is a good selection of active and passive funds from which to choose.

Best performing European OEICs over the last five years

| OEIC | ISIN | Fund size £ million | Annualised five-year performance | Dividend yield | Ongoing charge | Morningstar rating |

| GLG Continental Europe Prof (Acc) | GB00B0119487 | 136.5 | 15.8% | 0.9% | 1.05% | ***** |

| Henderson European Focus Fund I (Acc) | GB00B54J0L85 | 491.8 | 14.7% | 1.5% | 0.87% | ***** |

| BlackRock European Dynamic D | GB00B5W2QB11 | 1,926.5 | 14.3% | 1.3% | 0.93% | ***** |

| Scottish Widows HIFML European Focus 1 (Acc) | GB00B3BLSG41 | 11.1 | 14.1% | 0.1% | 1.73% | ***** |

| BlackRock Continental European Flexible D2RF EUR | LU0406496546 | 1,380.5 | 13.6% | n/a | 1.07% | **** |

Source: Morningstar, for Europe ex-UK Large Cap category, to 7 July 2015.

Where more than one class of fund features only the best performer is listed.

Best performing European investment companies over the last five years

| Investment company | EPIC | Market cap (£ million) | Annualised five-year performance * | Dividend Yield | Ongoing charges ** | Discount to NAV | Gearing | Morningstar rating |

| Jupiter European Opportunities | JEO | 522.8 | 21.7% | 0.7% | 1.06% | -0.4% | 8% | ***** |

| Henderson European Focus | HEFT | 194.4 | 17.5% | 2.4% | 1.59% | 1.4% | 18% | ***** |

| Henderson Euro | HNE | 177.3 | 15.9% | 2.1% | 0.90% | 1.4% | 5% | ***** |

| Fidelity European Values | FEV | 727.6 | 15.1% | 1.8% | 0.97% | -3.6% | 5% | **** |

| JP Morgan European Income | JETI | 101.2 | 14.6% | 3.8% | 1.93% | -3.8% | 8% | ***** |

Source: Morningstar, The Association of Investment Companies, for the Europe category, to 7 July 2015.

* Share price. ** Includes performance fee

Best performing European ETFs over the last five years

| EPIC | Market cap £ million | Annualised five year performance | Dividend yield | Total expense ratio | Morningstar rating | Replication method | |

| db x-trackers Stoxx Europe 600 UCITS ETF | XSX6 | 897.2 | 9.1% | n/a | 0.60% | **** | Physical / direct |

| db x-trackers MSCI Europe Index UCITS ETF | XMEU | 1,819.0 | 8.6% | n/a | 0.30% | **** | Physical / direct |

| iShares MSCI Europe UCITS ETF (Acc) EUR | IMEA | 433.2 | 8.6% | n/a | 0.33% | **** | Physical / direct |

| HSBC MSCI Europe UCITS ETF GBP | HMEU | 178.2 | 6.1% | n/a | 0.30% | **** | Physical / direct |

| iShares STOXX Europe 50 UCITS ETF GBP | EUN | 539.5 | 4.0% | n/a | 0.35% | *** | Physical / direct |

Source: Morningstar, for the Europe Large Cap Blend Equity Category, to 7 July 2015. Where more than one class of fund features only the best performer is listed.

Currency conundrum

Whether the Greek referendum leads to a formal rupture with Europe remains to be seen. There are rules for a country leaving the EU but there is no mechanism under the Treaty of Lisbon for exiting the single currency, so any departure could be messy. If Greece leaves the euro but stays in the Eurozone, the rules state it must eventually apply to join the single currency, unless it manages to wangle an opt-out and follow in the steps of the UK and Denmark.

No-one knows quite how any exit from the Eurozone would work but a piece of analysis from the Peterson Institute (www.iie.com) on the subject is worth reading. It argues

- Legislation would convert financial assets, liabilities and commercial and wage agreements from euros to a new currency (the drachma?) at par, alongside Government debt held by domestic institutions

- Banks would remain shut while their systems are reset for the new drachma

- When the banks re-open, the drachma floats – or in reality sinks – against the euro

- Greece begins to then negotiate on its overseas debts, which are still priced in euros, although holders would take an immediate haircut on the currency fall, which would make life uncomfortable for any Greek banks or firms with overseas borrowings. They may require financial help, deepening the initial economic impact of a ‘Grexit’

- Inflation would jump owing to the drachma’s fall and increased cost of imports. The Bank of Greece would have to act to rein this in, while the Government would have to ensure public sector salary increases were modest.

If the piece is correct,

- Greece will still suffer short-term economic pain because it has too much debt. The European solution of offering more debt to solve a debt crisis is failing (the rejected bail-out offer merely offers Athens to chance to pay off old liabilities with new ones, in exchange for reform). Greece’s €323 billion debt pile represents 180% of GDP and this cannot be sustained. Some form of debt forgiveness is therefore required, even if Greece has borrowed irresponsibly.

- The creditors, who it could be argued have lent money irresponsibly to a nation unable to pay them back, will have to take a haircut. Even if they don’t offer longer maturities at even lower rates, refuse to accept write-downs after orderly talks, they will lose out via a disorderly default and a devaluation of any new Greek currency, should a Greek exit eventually happen.

The EU remains as much as political as an economic construct but its leaders must acknowledge many Greeks may tire of their dream, or least its associated costs, with unemployment of 25% and youth unemployment of 50% or more. The EU was founded to promote peace and prosperity. It has succeeded in the former, since there has been no major Western European conflict since 1945. But Greeks will argue it is failing in the latter and civil unrest may not be far away if the banks remain closed for too long. The EU may therefore need to make concessions if it wishes to keep Greece in the fold and reassure Spain, Portugal and Italy that the long-term gains are worth it.

For their part the Greeks need to offer long-term changes to labour laws, inept public administration and tax collection and show they are serious about change. Even if they do give up on the euro and use a new drachma, they will need funding from somewhere, internal or external, tax or credit. The old drachma went from 30 to 400 against the dollar in the last 30 years of its existence as inflation ran rampant so Greece’s record of economic management is hardly one that will encourage lenders to queue up again. It must therefore help itself, too.

Scenario analysis

For the moment, the markets still seem to think there will be a deal and disorderly Greek plunge out of the euro can be averted. A number of indicators can be used to judge sentiment and the markets’ view on how all of this may play out, beside the already-flagged credit spreads.

- The euro has lost relatively little ground against the pound or dollar, at around the £0.71 and $1.11 marks respectively, though as the first chart here shows, with EURO/Pound on the right-hand axis and EURO/Dollar on the left, the general trend in the single currency so far this year has been down.

The euro is yet to lose further ground despite Greek concerns

Source: Thomson Reuters Datastream

If a euro fracture was likely you would logically expect currencies with independent central banks to do well against the single currency. The Swiss franc, Swedish krona or Danish kroner or the pound near to home, or the US or Singapore dollar would be potential options for currency traders or European citizens seeking to protect themselves from any fall-out.

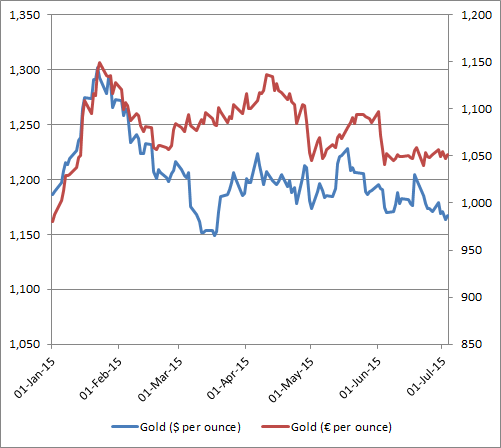

- That other currency option, gold, is not reacting either, in dollar or euro terms. Any spike would be a potential sign of market concern that Greece may exit and confusion would then reign.

The euro is holding up well against gold too

Source: Thomson Reuters Datastream

- Stock markets are jittery but hardly in panic mode. The Euro Stoxx 600 shed some of its gains ahead of the Greece’s failure to repay €1.5 billion in loans from the International Monetary Fund (IMF) the referendum vote but it has recorded an advance for the year as a whole, in euro and sterling terms, even if single currency weakness has eaten into returns from the latter.

Eurozone equities are still comfortably in positive territory for the year to date

Source: Thomson Reuters Datastream

Worst case

As a final point, it may be worth looking at the potential worst case and what might happen if the Greek situation does start to spin out of control. Some good research from Exane BNP Paribas shows how the Euro Stoxx 600 fared during four so-called “Greek crises” since 2010. The average loss was around 15%.

Eurozone stocks did badly during prior periods of Greek stress

Source: Exane BNP Paribas Research, Thomson Reuters Datastream

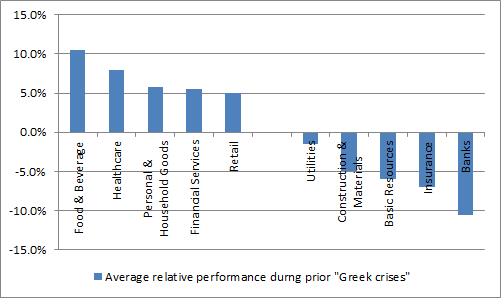

The next chart comes from the same piece shows which sectors did best – and worst – on a relative basis, on average, during those same four prior periods of Greek-inspired market turmoil.

The best were defensives – food and beverage, healthcare and personal and household goods, areas which represent a quarter of the FTSE 100’s market cap, by the way. The worst were Basic Resources, Insurance and Banks, which between them currently provide 31% of the FTSE 100’s aggregate market value. If there is any contagion or broader attack of nerves, the make up of the UK market may leave it a little exposed although its heavy weighting toward financials and miners could conceivably give it a boost should any ECB policy response include further QE.

Defensives did relatively well and financials badly during prior Greek dramas

Source: Exane BNP Paribas Research, Thomson Reuters Datastream

Russ Mould

AJ Bell Investment Director

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 02/05/2025 - 11:37

- Thu, 01/05/2025 - 16:33

- Thu, 01/05/2025 - 09:45

- Tue, 29/04/2025 - 11:41

- Fri, 25/04/2025 - 14:52