Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The 248th running of the St Leger is due to take place at its traditional home of Town Moor, Doncaster on Saturday and the stable of trainer Aiden O’Brien has a stranglehold on the big race, as the masterful Irishman trains the first three in the betting. Stock market investors will be keeping an eye on the event for different reasons, given the old saying about ‘Sell in May, go away and come back again on St. Leger day’.

This saying is based upon how, on average, the UK’s FTSE All-Share index has historically done best between January and April and then again after mid-September, with summer being a bit quiet by comparison.

The UK’s FTSE All-Share has not actually stayed true to type in 2024, because it has eked out a modest gain of 1.7% since 30 April, despite some notable volatility in the US and Japanese stock markets and also the technology and AI-related names which have done so well since the market bottom of autumn 2022. However, the saying survives for a reason, which is it contains more than a grain of truth.

FTSE All Share index since 1965

| Date | Average capital return | Increases | Decreases |

|---|---|---|---|

| 1 January to 30 April | 6.3% | 42 | 18 |

| 1 May to 10 September | (0.2%) | 31 | 29 |

| 11 September to 31 December | 2.3% | 41 | 18 |

Source: LSEG Refinitiv data. *To the close on 6 September

This pattern is not visible every year (investing would be far less difficult if it were). The FTSE All-Share has risen through to the end of April, dropped through to mid-September and then gained until the end of a year on just 16 occasions since 1965.

The UK market has not conformed to the traditional pattern this year, either, to beg the question of what UK stock market will do for the rest of the year (and then beyond) after its solid, if unspectacular, performance in the first eight-and-a-bit months of 2024.

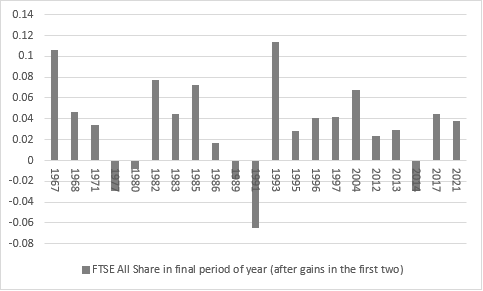

Before 2024, the All-Share index had gained in both January-April and May to the St Leger on 21 previous occasions since its inception in the early 1960s.

In those instances, the benchmark index progressed again in the final third of the year on sixteen occasions to record an average gain of 5.4% in the final three-and-a-half-month span. The outliers were 1977, 1980, 1989, 1991 and 2014 when (it could be argued) fears of inflation or recession, or at least a mid-cycle growth pause in the case of 2014, stalked the UK equity market, although such worries did not hold back the index on other occasions.

Source: LSEG Refinitiv data

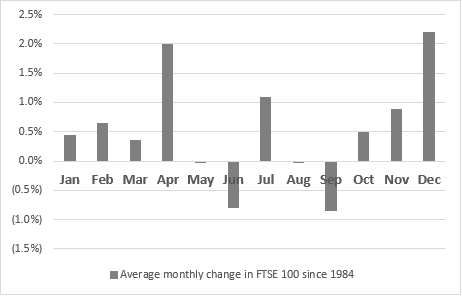

Oddly, September is the most difficult month of the year for UK equities, even if October is the one that conjures up the worst nightmares because of the crashes of 1929 and 1987.

The FTSE 100 may have a shorter lifespan than the All-Share, as its launch dates back to 1 January 1984, but it also shows, on average, the pattern of gains between January and April, a summer lull and then a final, year-ending (Santa) rally.

Source: LSEG Refinitiv data

The good news in 2024 for UK equities may be the lack of volatility exhibited elsewhere. Britain’s stock market has taken plenty of brickbats for being boring, but recent market action suggests that investors in AI and technology related stocks are getting an attack of the jitters.

The NASDAQ may still be up by 13% in 2024 (and thus outperforming the FTSE All-Share) but it is down by 10% since its 10 July peak and another 4% drop will take the NASDAQ back to where it was in November 2021 - as if to suggest the hoopla over AI and the Magnificent Seven was just a dream.

In this respect, the UK’s lower valuation, both in absolute terms and relative to its own history, coupled with the bumper cash returns it is offering via a combination of dividend payments, share buybacks and takeover bids, could be providing a little support, as investors wonder whether highflying tech stocks may have become overstretched after a stunning run.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 02/05/2025 - 11:37

- Thu, 01/05/2025 - 16:33

- Thu, 01/05/2025 - 09:45

- Tue, 29/04/2025 - 11:41

- Fri, 25/04/2025 - 14:52