Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Science-fiction writer Douglas Adams may not have been a massive fan of technology, judging by his jibe that “a mobile phone needs a manual in a way that a teacup doesn’t,” but stock market investors had very high hopes for the launch of Apple’s iPhone 16. Now we’ve got all the information on the new device, some investors might be asking whether the product lives up to the hype, given the mute market reaction immediately after the launch event.

In the six months leading up to the latest iteration of the device, Apple’s shares were up by 29%, well ahead of the average 21% gain that preceded prior launches, so iPhone 16 has a lot to live up to, especially as Apple’s stock has had a habit of running up strongly ahead of a new release and then doing relatively little in the immediate aftermath.

Change in Apple share price

| Before announcement | After announcement | ||||||

|---|---|---|---|---|---|---|---|

| Announced | Product | Launched | 6 months | 3 months | 3 months | 6 months | 12 months |

| 09-Jan-07 | iPhone 1 | 29-Jun-07 | 43.8% | 30.2% | 25.8% | 63.7% | 39.4% |

| 09-Jun-08 | iPhone 3G | 11-Jul-08 | (0.1%) | (5.9%) | (43.9%) | (47.5%) | 19.7%) |

| 07-Jun-10 | iPhone 4 | 24-Jun-10 | 28.7% | 17.3% | 8.7% | 20.3% | 21.3% |

| 12-Sep-12 | iPhone 5 | 21-Sep-12 | 16.2% | 69.9% | (25.8%) | (35.3%) | (33.2%) |

| 09-Sep-14 | iPhone 6 | 19-Sep-14 | 29.1% | 6.7% | 14.1% | 8.1% | 15.8% |

| 07-Sep-16 | iPhone 7 | 16-Sep-16 | 9.1% | 18.5% | (0.3%) | (8.3%) | 51.3% |

| 12-Sep-17 | iPhone X | 03-Nov-17 | 8.9% | 2.4% | 11.4% | 4.2% | 37.5% |

| 10-Sep-19 | iPhone 11 | 20-Sep-19 | 25.0% | 14.8% | 21.1% | 31.7% | 109.5% |

| 13-Oct-20 | iPhone 12 | 23-Oct-20 | 60.8% | 30.0% | 5.2% | 8.1% | 19.5% |

| 14-Sep-21 | iPhone 13 | 24-Sept-21 | 22.4% | 13.5% | 20.0% | 18.5% | 2.4% |

| 07-Sep-22 | iPhone 14 | 16-Sept-22 | (5.6%) | 15.9% | (10.7%) | 3.4% | 16.1% |

| 12-Sep-23 | iPhone 15 | 22-Sept-23 | 10.7% | (6.5%) | 10.8% | (11.0%) | 14.1% |

| 09-Sep-24 | iPhone 16 | 20-Sep-24 | 29.3% | 12.2% | |||

| Average | 21.4% | 16.8% | 3.0% | 4.6% | 22.8% | ||

Source: Company accounts, LSEG Refinitiv data

Apple needs to shake off accusations that it is lagging in the field of Artificial Intelligence, and iPhone 16 therefore needs to prove it can compete with rival offerings such as Samsung’s Galaxy S24 and Alphabet’s Google Pixel 9.

The new iPhone will have new ‘Apple Intelligence’ tools for writing and uses ChatGPT to help with certain queries. However, these features won’t be immediately available to all customers.

The so-called Magnificent Seven of Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla have already shed $2.5 trillion (or 15%) of their combined market capitalisation since the peak in July of this year, as doubts about their lofty valuations, worries about increased regulatory pushback and more questions about the degree and timing of the payback for companies that are spending heavily on AI continue to gather.

Apple’s shares have proved the most resilient among the septet, with a drop of barely 5% since mid-July, compared to a retreat of nearly a quarter at NVIDIA, and this may be due to how the real driver of Apple’s business now is higher-margin services rather than hardware sales.

That provides a steady (and still growing) stream of very profitable, and very sticky, revenues, as the app ecosystem and users’ familiarity with it means Apple fans stay very loyal. Apple discloses gross margins for both revenue streams and on services it is 74% compared to 35.4% for hardware products such as iPhones, iPads, iMacs and wearables, according to the latest quarterly, regulatory filing.

However, regulators are taking a keener interest in the app ecosystem and whether or not it is a walled garden designed to block out competition (and bill users) unfairly, and Apple has just lost an EU court battle over a €13 billion tax bill in Ireland.

As such, a lot does ride on the iPhone 16 as analysts look for the device to stoke a major upgrade cycle among Appleholics, who have not really splurged on new phones since 2021’s lockdowns. Product sales in total have fallen year-on-year five times in the past seven quarters and the iPhone has generated lower revenues in each of the last two, thanks to competition and – perhaps – the wait for this latest generation device.

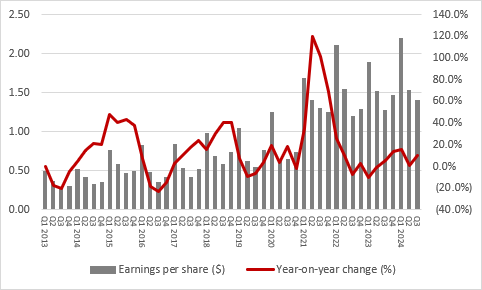

Apple has already suffered four profit slides in the past decade, and the first three were largely related to the iPhone’s product cycles and its functionality, price points and demand in China (the early stages of the pandemic contributed to the last one).

The subsequent share price surge may mean that January 2020’s crunching profit warning is but a distant memory, but it does not mean it cannot happen again if the latest set of product features fail to capture consumers’ imaginations, especially given how the hefty $3.3 trillion stock market valuation already prices in an awful lot of good news (and future cash flow).

Source: Company accounts. Financial year to September.

Strong as the cash flow remains, the balance sheet also offers less downside protection than it once did. Apple’s net cash pile peaked at more than $160 billion, but that has since been whittled down to $52 billion by more than $800 billion in share buybacks and dividend payments over the past decade.

Analysts seem confident enough that such downside protection is not needed, however, as their forecasts suggest iPhone16 will drive a resurgence in profit momentum. Consensus estimates currently suggest earnings per share (EPS) will grow by 12% in the year to December 2025 for what would be the first year of double-digit percentage progress since lockdown inspired a major round of device and app buying back in 2021.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 02/05/2025 - 11:37

- Thu, 01/05/2025 - 16:33

- Thu, 01/05/2025 - 09:45

- Tue, 29/04/2025 - 11:41

- Fri, 25/04/2025 - 14:52